Cemex 2Q24: Solid Performance in Mexico Offsets Softness in the US

We maintain our Outperform recommendation on Cemex

Executive Summary

We maintain our Outperform recommendation on Cemex. The company benefits from favorable market trends in its key markets, a strong commitment to further strengthening its credit profile, ample liquidity, and credit-positive strategic priorities, including optimizing its portfolio and improving profitability and cash generation, supporting our positive view.

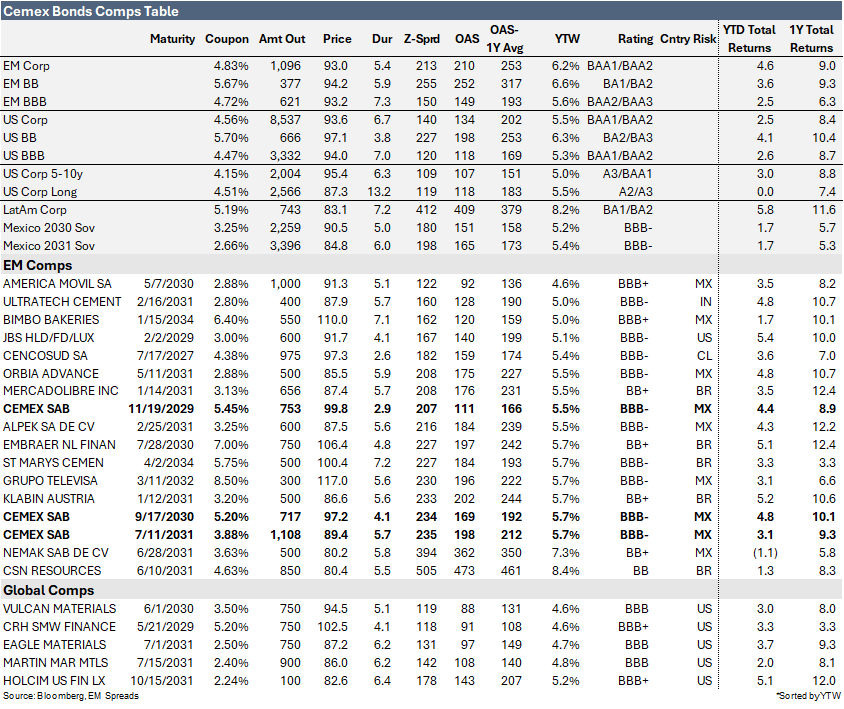

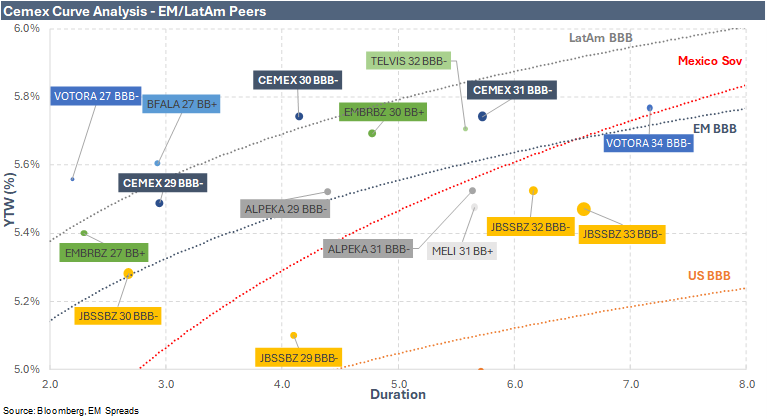

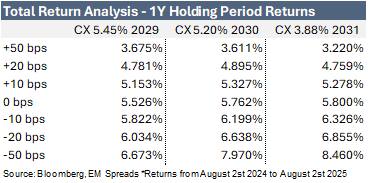

For EM investors, we prefer CX 5.20% 2030, considering these bonds are trading wide to the Mexican Sovereign, the EM BBB Index, and the LatAm Index. Over the next year, the notes offer an additional 10-30 bps compression potential and a more favorable risk-return profile than the current spread levels on CX 5.45% 2029 notes and CX 3.88% 2031 notes

For US investors, CX’s operating performance is significantly dependent on the US and, to a lesser extent, Europe, and we expect this to increase in the coming years. Consequently, it is worth comparing CX’s notes to those of other US peers. Cemex bonds remain compelling, given that the 2030 bonds are trading wide to the broader US BBB Index and yielding around 1.0 percentage points higher than comparable US peers.

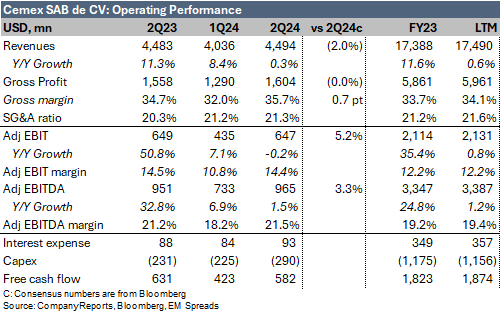

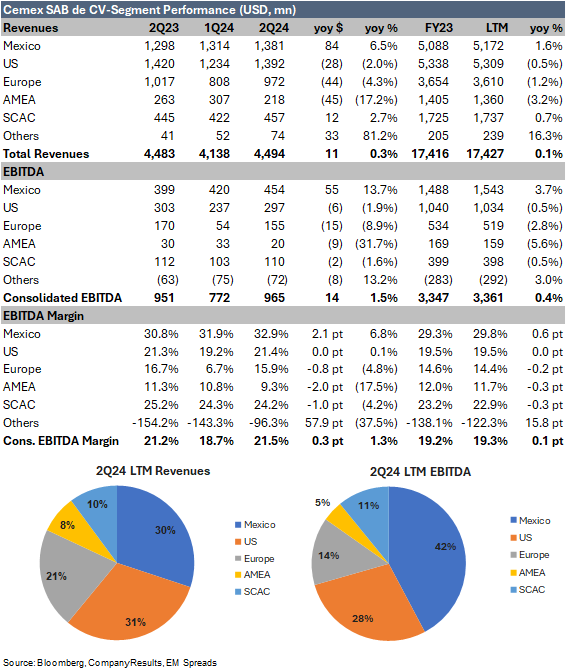

Despite challenging conditions, Cemex's top line for 2Q24 remained relatively flat, while adjusted EBITDA aligned with expectations, rising by 1.5% yoy. The company experienced trends similar to those in the first quarter, with lower consolidated volumes offset by price improvements. Increased sales in Mexico and SCAC counterbalanced declines in the US and EMEA regions. Notably, the EBITDA margin expanded by 30 basis points, reflecting the effectiveness of the company’s pricing strategy, which outpaced the deceleration in input cost inflation.

Mexico 2Q24 revenue increased by 6.5% yoy to $1.4 billion. Improved prices and solid volumes primarily drove the growth. EBITDA from Mexico saw a significant improvement, rising by 13.7% to $454 million from $399 million in 2Q23. EBITDA margin expanded 2.1 percentage points to 32.9% from 30.8% in the previous year. The margin expansion was supported by price increases and a deceleration in costs, particularly energy.

United States 2Q24 revenue declined 2.0% yoy to $1.4 billion. The decrease was mostly due to lower volumes partially offset by higher prices. Cement, ready-mix, and aggregates volumes decreased by 7%, 12%, and 2%, respectively. EBITDA from the US decreased 1.9% yoy to $297 million from $303 million in 2Q23, with EBITDA margin modestly expanding about 3 bps to 21.4%, mainly driven by higher prices and lower cost inflation, primarily for fuel and imports.

We anticipate that market dynamics will remain healthy in 2024. This outlook is primarily driven by robust infrastructure spending in Mexico, supported by nearshoring-related activity and a strong pipeline of infrastructure projects in the US. Additionally, construction fundamentals in Mexico and the US showed positive signs in 2Q24, with healthy construction spending, improved pricing, and a favorable macroeconomic environment.

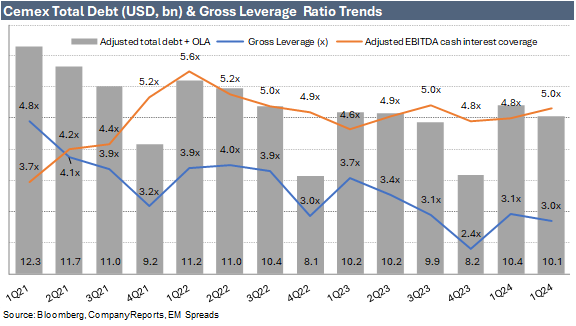

Cemex ended the quarter with $10.1 billion of total debt, down $357.0 million sequentially, mostly driven by the reclassification of the debt associated with CX Philippines. Gross and net leverage declined by one tick sequentially to 3.0x and 2.8x, respectively. FFO to debt increased to 19.9% as of June 2024, up from 19.4% as of March 2024, and EBITDA cash interest coverage improved to 5.0x from 4.8x sequentially.

Cemex’s credit story is limited by (1) the cyclicality and capital-intense nature of the cement industry, (2) political risk, particularly in an election year within Cemex’s key markets, (3) foreign currency risk and overall country risk as the company operates within many high-risk countries, and (4) and the intensely competitive landscape of the industry.

Trade Recommendation

We continue to see Cemex as an attractive emerging market credit story. It recently achieved its long-time goal of regaining its investment grade rating, and we maintain our Outperform recommendation. The company benefits from its leadership position as one of the world's largest cement producers and a clear market leader within the highly profitable Mexican market, bolstering its solid business position. Cemex has demonstrated its commitment to a prudent financial policy, consistently improving its credit metrics through healthy cash generation while maintaining financial flexibility and ample liquidity. We expect Cemex to remain committed to its prudent financial policy. Over the next year, it should continue strengthening its balance sheet and credit metrics supported by the currently positive market trends in its key markets and favorable pricing strategies, resulting in healthy operating cash flows. However, the cement production industry's cyclical and capital-intense nature poses some limitations to the credit story. At the same time, it also faces political exposure, dependency on US-Mexico relations, and foreign exchange risk.

We find CX (BBB-/BBB-) 5.20% 2030 bonds yielding 5.7% for the 4.0-year duration attractive at current spread levels. These notes are trading wider than the Mexican Sovereign, EM BBB, and US BBB curves. In comparison, the broader EM BBB Index yields 5.6%, the broader US BBB Index yields 5.3%, and the Mexican Sovereign bonds maturing in 2030 yield 5.2%. Current yields also compared favorably to BBB- rated peers, such as JBSBZ (Baa3/BBB-/BBB-) 3.00% 2029 notes yielding 5.1% for the 4.1-year duration, UTCMIN (Baa3/BBB-) 2.80% 2031 bonds yielding 5.0% for the 5.7-year duration, and VOTRA (Baa3/BBB) 5.75% 2034 notes yielding 5.7% for the 7.2-year durations. We prefer CX 5.20% 2030 notes trading wider than the Mexico Sovereign, EM BBB index, LatAm BBB index, and peers.

Considering the company’s significant exposure to the US and Europe, we find it beneficial to analyze Cemex’s bonds compared to US peers. When we compare CX’s bonds to the broader US market and its peers within the cement industry, CX’s bonds appear attractive. The broader US Index yields 5.5%, with the broader US BBB Index yielding 5.3%, and the US Corp 5–10-year Index yielding 5.0%, which compares favorably to CX 2029 notes yielding 5.5% and CX 2030 notes yielding 5.7%. In terms of valuation versus US peers, CX 2030 notes look wide compared to VMC (Baa2/BBB+/BBB) 3.50% 2030 notes yielding 4.6% for the 5.1-year duration, EXP (Baa2/BBB) 2.50% 2031 bonds yielding 4.7% for the 6.2-year duration, and MLM (Baa2/BBB+/BBB) 2.40% 2031 notes yielding 4.8% for the 6.2-year duration. For investors comfortable with this dynamic, we view CX as a compelling option to pick up yield in the cement industry.

Total Return Analysis

2Q24 Operating Performance

Cemex (BBB-/BBB-) 2Q24 revenues increased modestly by 0.3% yoy to $4.5 billion. However, the top line was 2.0% below consensus expectations, primarily due to lower-than-expected cement volumes (-7% yoy) and ready-mix volumes (-12%) in the US. The operating trends in the quarter were similar to those in the previous quarter, with lower consolidated volumes partially offsetting price improvements. Difficult weather conditions in Mexico and the USA negatively impacted volumes. While improved sales were noted in Mexico and SCAC, these gains were offset by declines in the US and EMEA. Despite flat cement volumes, -9% ready-mix volumes, and -3% aggregates volumes, Cemex saw a 2% yoy increase in consolidated cement prices in USD, a 4% increase in ready-mix prices, and a 3% increase in aggregates prices. Cemex’s management expects prices to continue outpacing inflation across markets.

Gross profit was $1.6 billion, up 3.0% yoy. The gross margin expanded 0.9 percentage points to 35.7% from 34.7%, driven by improved customer pricing and cost tailwinds, primarily in energy used for cement production. The cost of goods sold decreased 1.2% yoy to $2.9 billion in the quarter.

In 2Q24, adjusted EBITDA increased 1.5% yoy to $965.1 million, up from $950.6 million in 2Q23. The adjusted EBITDA margin expanded to 21.5% from 21.2%, reflecting Cemex’s effective pricing strategy, which outpaced decelerating input cost inflation and improved the price-to-cost ratio. Additionally, growth investments and urbanization solutions positively contributed to the EBITDA improvement.

Looking ahead, Mexican construction fundamentals remained relatively healthy in July compared to historical figures. Construction spending in Mexico increased 3.1% yoy, while the construction activity index reached 118 in June. Although construction business confidence decreased, it remained modestly above 50, indicating expansionary territory. Mexico’s GDP per capita is expected to grow by 2.0% in 2024 and 1.8% in 2025, with inflation projected to remain around 4.5% in 2024 and 3.7% in 2025. We anticipate volumes softening in the second half of 2024 as port-election government spending declines, coupled with several current administration mega-infrastructural projects phasing out the cement-intensive period. However, we remain optimistic about Cemex's outlook, which is driven by the federal government's supportive agenda for building housing and infrastructure to support nearshoring projects, among other factors. Following an 8.8% increase in 2023 and a 6.6% yoy growth in 1Q24, cement prices in the US increased by 6.9% yoy in 2Q24. US construction spending increased by 9.3% in 2023, 9.2% in 1Q24, and 7.3% in 2Q24. As a result, we anticipate Cemex’s volumes in the US to improve in 2H24, supported by positive underlying demand in infrastructure and industrial projects related to onshoring and clean energy, market share recovery, and easier comparisons. Concurrently, price increases should also improve profitability.

2Q24 Segment Results

Mexico revenue (30% of LTM total revenue) increased by 6.5% yoy to $1.4 billion in 2Q24, primarily driven by improved prices of Cemex’s products and solid volumes. This top-line improvement was supported by price increases in cement (+4% yoy in USD), ready-mix (+7%), and aggregates (+4%) along with higher volumes in cement (+5%), ready-mix (+2%), and aggregates (+3%). EBITDA generated in Mexico improved significantly by 13.7% to $454 million in 2Q24, up from $399 million in 2Q23. The EBITDA margin expanded 2.1 percentage points to 32.9% from 30.8% during the same period. In addition to price increases, the margin expansion was supported by decelerating costs, primarily energy.

Despite the adverse weather conditions in June, volumes remained strong in the quarter. Infrastructure and nearshoring activities, particularly in the North and Southeast of the country, continued to be the main growth drivers. Additionally, increased social spending and a favorable comparison base benefited bagged cement volumes. Cemex 2024 Mexico volume guidance remained unchanged. The company still expects volumes to soften in the second half of 2024 due to the anticipated declines in post-election government spending and the completion of the cement-intensive phases of the current administration’s mega-infrastructure projects. However, management mentioned a healthy backlog of projects in formal construction, especially those related to nearshoring and infrastructure. Despite the recent inflation increases, the company anticipates prices will continue to outpace inflation across its markets. Additionally, management highlighted the company's transition from petcoke to natural gas, which is expected to improve profitability.

Cemex remains optimistic about the medium-term outlook for cement demand in Mexico. This optimism is supported by the new federal government’s agenda, which appears favorable. The government aims to increase housing by around 1 million units and focus on building Mexico’s infrastructure to support nearshoring projects. Cemex also expects cement demand to be bolstered by social programs, low unemployment, wage growth, and a governmental focus on low-income housing. Additionally, management highlighted interest from the federal government in replicating Cemex’s initiatives to repurpose the Mexico City waste stream in other cities.

United States revenue (30% of LTM total revenues) declined by 2.0% yoy to $1.4 billion in 2Q24, mostly due to lower volumes partially offset by higher prices. Cement, ready-mix, and aggregates volumes decreased by 7%, 12%, and 2%, respectively. The decline in cement and ready-mix volumes was mainly due to adverse weather conditions, including heavy precipitation, a softening residential sector (particularly multifamily), portfolio rationalization, competitive dynamics in certain markets, and the timing of several large projects. Aggregates volumes were less affected by weather conditions, resulting in a more controlled decline. Cemex estimated that weather conditions accounted for approximately 25% of the decline in cement volumes. However, cement, ready-mix, and aggregates pricing in USD improved by 4%, 7%, and 4%, respectively, driven by the company’s effective pricing strategy. In line with the revenue decline, US EBITDA decreased by 1.9% yoy to $297 million in 2Q24 from $303 million in 2Q23. The EBITDA margin expanded modestly by about 3 bps to 21.4%, mainly driven by higher prices and lower cost inflation in fuel and imports.

In the 2Q24 earnings call, management indicated that volumes are expected to improve in the second half of 2024, supported by positive underlying demand in infrastructure and industrial from projects related to onshoring and clean energy, market share recovery, and easier comparisons. Regarding pricing, around 70% of the country (excluding Texas and Northern California) experienced price increases in the first half of 2024, with additional price hikes implemented in Texas in July. Cemex communicated that its recent joint venture agreement with Couch Aggregates should strengthen its aggregate reserves and distribution capabilities in the Mid and South markets. Regarding residential recovery, Cemex mentioned that the sector is not recovering as fast a trajectory as expected at the beginning of the year. However, the company remains optimistic in its mid-term outlook, citing expected improvements in interest rates and some market pricing adjustments.

2Q24 Europe revenue was $972 million, down 4.3% from $1.0 billion in 2Q23. The decline was mostly due to lower volumes, as the region faces slow growth in Western Europe and the ongoing construction ban in Paris ahead of the Olympics. EBITDA generated in Europe declined by 8.9% yoy to $155 million in 2Q24, with the EBITDA margin contracting by 0.8 percentage points to 15.9%. Europe continues to experience a divergence in volume performance between Western and Eastern Europe. Western European countries such as the UK, Germany, and France experienced declines, while Eastern European countries such as the Czech Republic, Poland, and Croatia showed significant increases. Despite these challenges, prices across the region have remained resilient, with flattish yoy and sequential performances.

In AMEA, revenue declined 17.2% yoy to $218 million in 2Q24 from $263 million in 2Q23. AMEA EBITDA decreased 31.7% yoy to $20 million in the quarter, with the EBITDA margin contracting to 9.3% from 11.3%. The region faced negative impacts from the war in Israel and significant adverse FX effects in Egypt. Additionally, with Cemex planning to divest its Philippines operations by year-end, the Philippines business has been reclassified as discontinued and excluded from the 2024 operating results.

SCAC revenue was $457 million in 2Q24, up 2.7% yoy from $445 million in 2Q23. This was driven by solid price increases, which offset declining volumes. Price increases were reflected in cement (+4% yoy in USD), ready-mix (+19%), and aggregates (+6%), offsetting lower volumes of ready-mix (-8%) and aggregates (-1%). EBITDA decreased by 1.6% to $110 million in 2Q24, with the EBITDA margin contracting to 24.2% from 25.2%. Higher maintenance costs offset the positive pricing contribution and lower energy and raw material costs.

Guidance

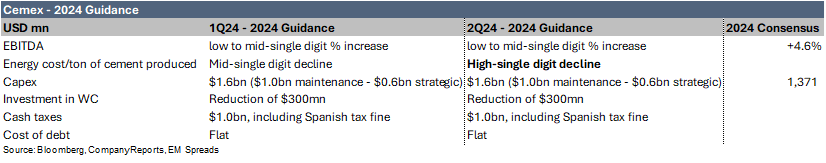

In the second quarter of 2024, Cemex's management maintained its 2024 guidance largely unchanged. However, they updated their expectation for a more significant reduction in energy costs per ton of cement produced, projecting a high-single-digit decline compared to the previously anticipated mid-single-digit decline.

Cemex’s management provided an updated volume guidance for 2024. The guidance for cement and aggregates volumes remains unchanged, with expectations for cement volumes to increase by a flat to low-single-digit percentage and aggregates volumes to decline by a flat to low-single-digit percentage. However, ready-mix volumes are now expected to decline by low-single digits, a deterioration from the previous guidance of a flat to low-single-digit decline. In Mexico, the volume guidance remains unchanged. For the USA, ready-mix volumes are anticipated to decline by mid-single digits, worse than the low-single-digit decline projected in 1Q24, and aggregates volumes are expected to be flat compared to the previously expected low-single-digit increase.

Financial Profile and Liquidity

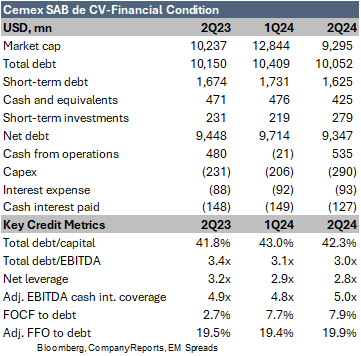

Cemex ended 2Q24 with $10.1 billion in total reported debt, down $357 million sequentially from $10.4 billion as of March 2024 (December 2023: $8.2 billion). The debt reduction was driven mainly by reclassifying the debt associated with CX Philippines, which is considered assets/liabilities held for sale. Our total reported debt includes leasing obligations of $1.2 billion as of June 2024 and 100% of the two perpetual hybrid subordinated bonds totaling $2.0 billion. Of this, $1.3 billion was short-term debt, and $276 million was short-term leases. As of June 2024, cash and cash equivalents were $705 million, up modestly sequentially from $695 million as of March 2024 (December 2023: $624 million). Consequently, net debt decreased to $9.3 billion as of June 2024 from $9.7 billion as of March 2024 and $7.5 billion as of December 23.

We note that credit rating agencies considered the subordinated bonds 50% equity and 50% debt mainly because the notes are subordinated, rank senior only to share capital and coupon payments can be deferred at the issuer’s discretion.

Higher profitability in the quarter drove adjusted EBITDA to $965.1 million, comfortably covering $290.3 million of capex and $92.7 million of interest expense, resulting in $582.1 million of free cash flow. After -$35.9 million in changes in working capital, -$272.7 million in taxes, $14.3 million in assets sold, $7.1 million in acquisitions, and $30.1 million in dividends, net free cash flow was $222.1 million in the quarter.

Funds from operations (adjusted EBITDA minus cash interest paid and cash tax paid) were $535.1 million in 2Q24, modestly down from $559.7 million in 2Q23 (1Q24: $405.6 million). Adjusted EBITDA covered comfortably $157.3 million of cash interest paid, including $30.0 million of interest on Cemex’s subordinated debt and $127.3 million of cash tax paid. The company’s interest expense was $92.7 million in 2Q24, up from $88.1 million in 2Q23 (1Q24: $92.4 million), while cash interest paid was $157.3 million, lower than $178.4 million in 2Q23 (1Q24: $179.4 million).

Free operating cash flow (cash from operations minus capex) was $244.9 million in the quarter, relatively stable from $248.1 million in 2Q23. Cash from operations was $535.2 million in 2Q24, up from $479.5 million in 2Q23 (1Q24: -$20.9 million). Capex was $290.3 million in 2Q24, up from $231.4 million in 2Q23 and $206.0 million in 1Q24. During the quarter, Cemex initiated its dividend program consisting of equal quarterly dividend distributions totaling $120 million in the first year, with the first payment of $30.1 million distributed in 2Q24.

Cemex’s liquidity remains healthy. The company has $1.6 billion in short-term debt, including factoring and operating leases, covered by total liquidity of $2.4 billion, $425.4 million in cash, $279.5 million in short-term investments, and $1.7 billion in revolver availability. As of June 24, Cemex’s liquidity covered its short-term debt by 1.5x, providing a protective shield in a cyclical industry.

Cemex hedges approximately three-quarters of its emerging market currency exposure, mostly the Mexican peso, with forward positions extending up to 24 months. The CFO recently highlighted that these hedges allow the company to manage scenarios ranging from a ~10% appreciation to a ~40% depreciation of the Mexican peso. Additionally, Cemex hedges around 70% of its energy exposure, including electricity, transportation fuels, maritime shipping, and third-party transportation fuel costs. The company has also begun hedging its petcoke position. Cemex’s debt amortization profile is healthy, with no material debt maturities until 2026. Management remains committed to strengthening its capital structure and aims to reduce leverage by half a turn in the next 24-36 months.

As a result, key credit metrics were modestly stronger, supported by a lower debt balance, higher EBITDA, and lower cash interest paid:

Gross leverage increased to 3.0x as of June 2024 from 3.1x as of March 2024 (June 2023: 3.4x).

Net leverage was 2.8x as of June 2024 compared to 2.9x as of March 2024 (June 2023: 3.2x).

Adjusted EBITDA cash interest coverage improved sequentially to 5.0x from 4.8x (June 2023: 4.9x).

FFO to debt increased to 19.9% as of June 2024 from 19.4% as of March 2024 (June 2024: 19.5%).

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.