Cemex 3Q24: Long-Term Outlook Clouded by Near-Term Risks

Cemex downgraded to Market Perform

Executive Summary

We downgraded Cemex to Market Perform. While we continue to view Cemex as an attractive emerging market credit story supported by favorable market conditions, credit-positive strategic priorities, and a commitment to strengthening its credit profile, we believe the risk/reward profile is skewed to the downside. This view is based on current spread levels, weak earnings results, and elevated near-term political and headline risks.

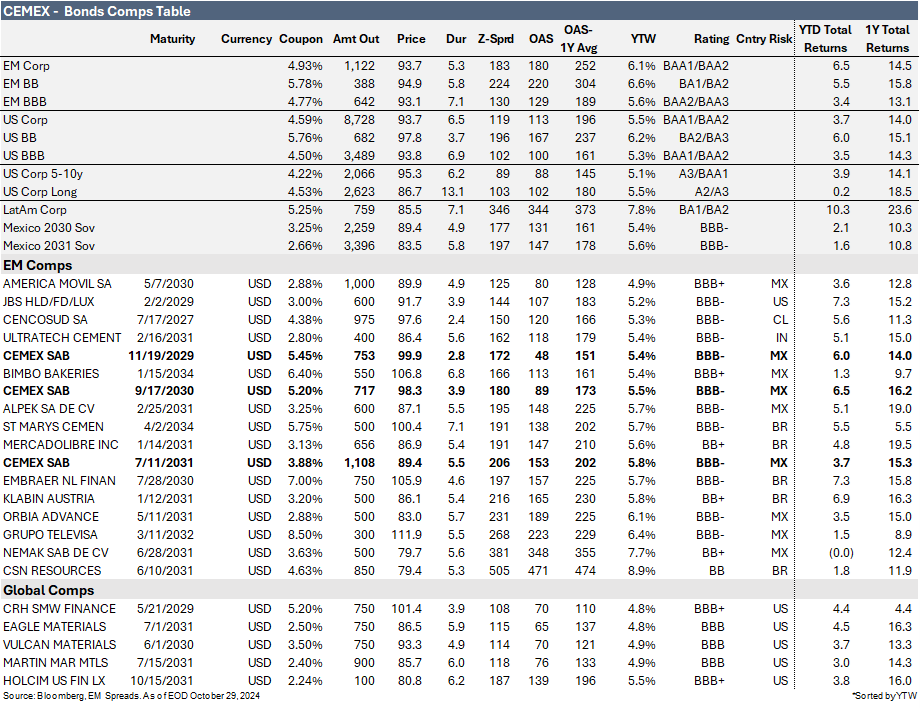

For EM investors, we prefer Cemex 5.20% 2030 bonds, as they are trading wide to the Mexican Sovereign and the EM BBB Index. However, we do not anticipate these notes will outperform in the near term.

For US investors, Cemex’s operating performance is significantly dependent on the US and, to a lesser extent, Europe, and we expect this to increase in the coming years. Consequently, it is worth comparing Cemex’s notes to those of other US peers. However, Cemex’s bonds no longer appear compelling at currently tight spread levels, and we believe Cemex’s risk/reward profile is skewed to the downside in the near term.

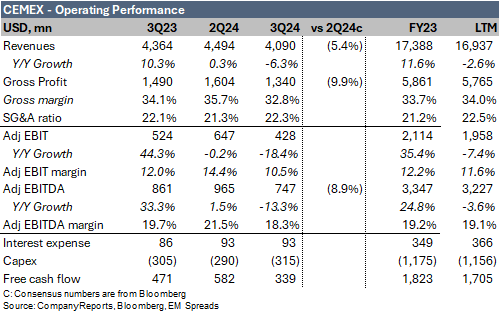

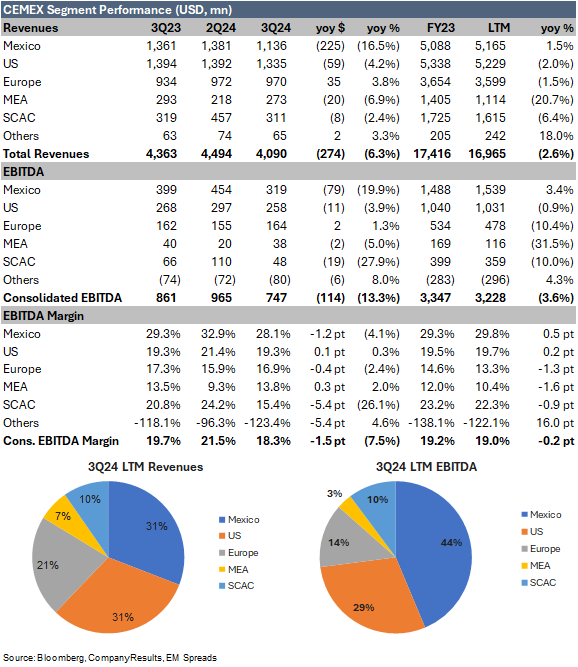

Cemex 3Q24 results were weaker than expected. Cemex reported a 6.3% decline in 3Q24 revenues to $4.1 billion (l-t-l: -3%), missing consensus expectations by 5.4%. This shortfall was primarily due to weaker volumes in Mexico and the US and the impact of MXN depreciation. Adjusted EBITDA decreased by 13.2% YoY (l-t-l: -9%) to $746.7 million from $861.1 million in 3Q23, coming in 8.9% below consensus expectations.

Mexico 3Q24 revenue decreased 16.5% (l-t-l: -5%) YoY to $1.1 billion, and EBITDA fell 19.9% (l-t-l: -8%) to $319 million. Operations in Mexico were affected by lower volumes and reduced prices in US Dollars. Volumes were negatively impacted by reduced construction activity following the June election and adverse weather, with precipitation levels 50% higher YoY.

US 3Q24 revenue declined 4.2% YoY to $1.3 billion, and EBITDA decreased 3.9% to $258 million. US operations were affected by lower volumes, partially offset by higher prices. Volumes were particularly impacted by adverse weather conditions, including three major hurricanes, above-average precipitation, and flooding.

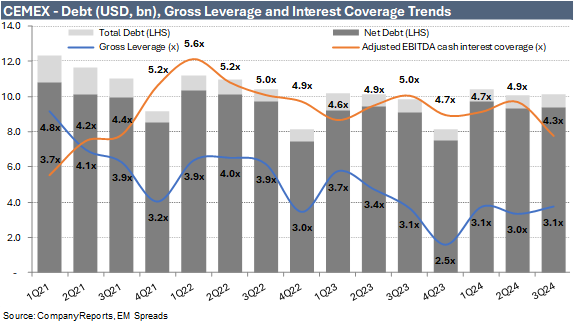

Cemex ended the quarter with $10.1 billion of total debt, up $60.8 million sequentially. Net debt increased $68.3 million QoQ to $9.4 billion. Gross and net leverage increased by one tick sequentially to 3.1x and 2.9x, respectively. FFO to debt decreased to 16.0% as of September 2024, down from 19.4% as of June 2024, and EBITDA cash interest coverage deteriorated to 4.3x from 4.9x sequentially.

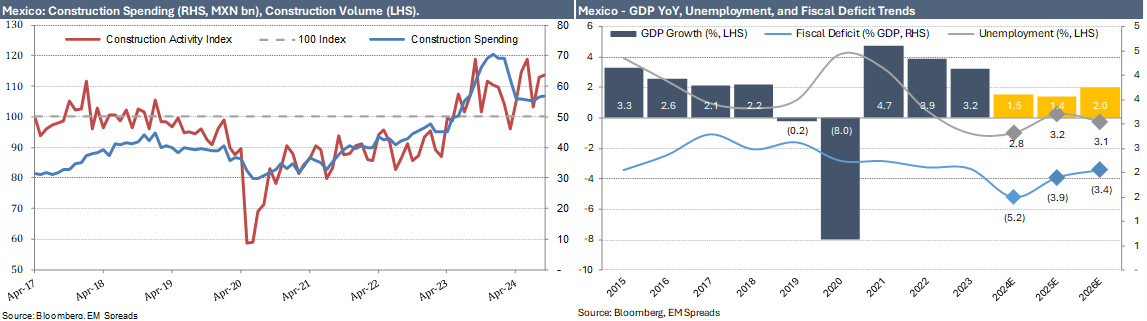

We anticipate healthy market dynamics in 2025. This outlook is primarily driven by robust infrastructure spending in Mexico, supported by nearshoring-related activity and a strong pipeline of infrastructure projects in the US. Additionally, construction fundamentals in Mexico and the US showed positive signs in 3Q24 vs historical figures, with healthy construction spending, improved pricing, and a favorable macroeconomic environment.

During the quarter, Cemex made meaningful progress toward its strategic goals. Cemex announced $2.2 billion in divestments and projected that 90% of its EBITDA will come from the US, Europe, and Mexico post-divestment.

Cemex’s credit story is limited by (1) the cyclicality and capital-intense nature of the cement industry, (2) political risk, particularly in an election year within Cemex’s key markets, (3) foreign currency risk and overall country risk as the company operates within many high-risk countries, and (4) the intensely competitive landscape of the industry.

Trade Recommendation

We continue to view Cemex as an attractive emerging market credit story but now have a Market Perform recommendation. Cemex reported weaker-than-expected 3Q24 results and revised its 2024 EBITDA guidance to a low single-digit decrease, primarily due to adverse weather in the US and Mexico impacting volumes and margins, though Europe delivered positive performance. Nonetheless, macroeconomic uncertainties in Mexico—including a recently elected nationalistic administration, a significant fiscal deficit, sub-2% GDP growth, dependency on uncertain US-Mexico relations, and foreign exchange risk—add pressure to the credit story. We believe that the combination of tight spread levels and political uncertainty, including the potential for a second Trump presidency, which may initially be perceived as a negative for US-Mexico relations, significantly increases the notes' headline risk, limiting a potential outperformance.

During the quarter, Cemex made meaningful progress toward its strategic goals, announcing $2.2 billion in divestments and projecting that 90% of its EBITDA will come from the US, Europe, and Mexico post-divestment. We anticipate positive results in 2025, driven by favorable demand drivers, including robust infrastructure and housing spending in Mexico supported by nearshoring and increased demand for infrastructure in the US, with only half of the IIJA funding allocated to date. Mexico’s new government agenda, which emphasizes housing and infrastructure, should benefit Cemex as a leading global cement producer and a dominant player in the profitable Mexican market. The Mexican government has announced plans to build 1 million homes over the next six years and develop ten economic corridors nationwide to leverage nearshoring opportunities.

Cemex has demonstrated a commitment to prudent financial policies, consistently improving credit metrics, including its 1.5x leverage target over the next two years, through solid cash generation while maintaining financial flexibility and ample liquidity. We expect Cemex to remain committed to this approach and believe it could evolve into a mid-BBB credit. Cemex will likely continue strengthening its balance sheet and credit metrics, supported by favorable 2025 market trends in key markets and effective pricing strategies, which are expected to yield healthy operating cash flows. However, the cyclical and capital-intensive nature of the cement industry presents some limitations to this credit story.

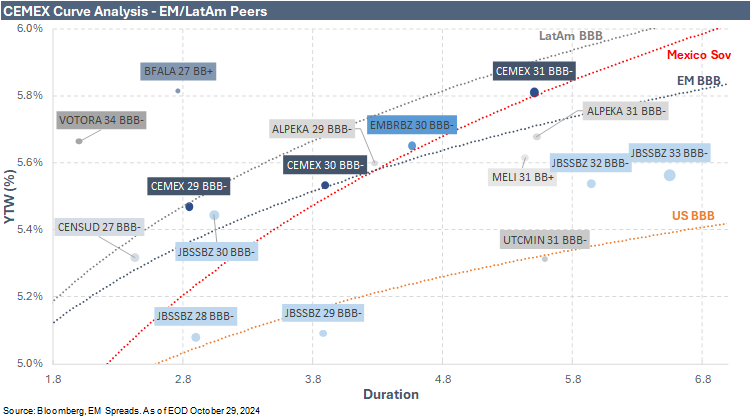

We find CEMEX (BBB-/BBB-) 5.20% 2030 bonds yielding 5.5% for the 3.9-year duration modestly attractive at current spread levels. These notes are trading slightly wider than both the Mexican Sovereign and EM BBB curves. For comparison, the broader EM BBB Index yields 5.6%, the broader US BBB Index yields 5.3%, and Mexican Sovereign bonds maturing in 2030 yield 5.5%. Current yields also compare favorably to BBB- rated peers, such as JBSBZ (Baa3/BBB-/BBB-) 3.00% 2029 notes yielding 5.1% for the 3.9-year duration, UTCMIN (Baa3/BBB-) 2.80% 2031 bonds yielding 5.3% for the 5.6-year duration, and VOTORA (Baa3/BBB) 5.75% 2034 notes yielding 5.7% for the 7.2-year duration. We prefer the CEMEX 5.20% 2030 notes, which are trading wider than the Mexican Sovereign, EM BBB index, and comparable peers, though we do not anticipate these notes to outperform in the near term.

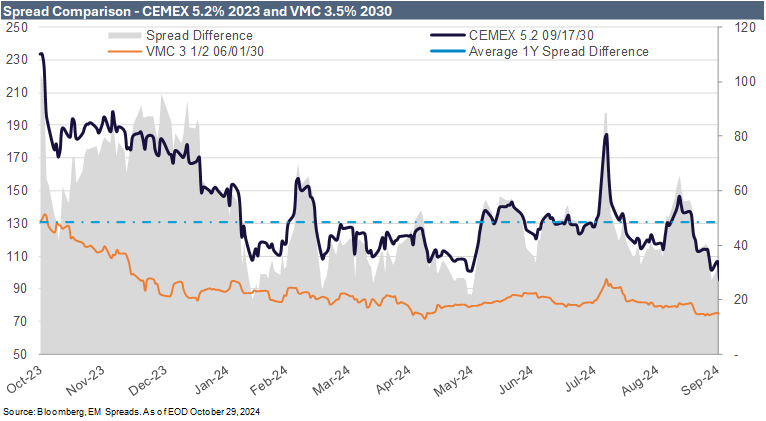

Given Cemex’s significant and growing exposure to the US and Europe, we find it beneficial to analyze Cemex’s bonds in comparison to the US market and US peers. Compared to the broader US market and peers within the cement industry, Cemex’s bonds no longer appear compelling at currently tight spread levels. The spread difference between CEMEX 2030 notes trading at 85 bps and VMC 3.5% 2030 notes at 69 bps is around 16 bps—significantly below the 1-year average of 48 bps. The spread difference reached 89 bps in early August, meaningfully higher than current levels. We believe Cemex’s risk/reward profile is skewed to the downside. Still, those investors comfortable wading through near-term volatility should be rewarded by a wider spread relationship at some point over the next 12 months closer to around 50 bps, which we consider fair value.

The recent weak 3Q24 results, which damped operational momentum to catalyze what we view as Cemex moves toward becoming a mid-BBB credit, support this view. Additionally, we see current headline risk as elevated, as the market increasingly anticipates a second Trump presidency, which we expect to be at least initially perceived negatively for US-Mexico relations. Consequently, we find CEMEX bonds uncomfortably tight relative to US peers at current spread levels.

3Q24 Operating Performance

Cemex (BBB-/BBB-) reported a 6.3% decline in 3Q24 revenues to $4.1 billion (l-t-l: -3%), missing consensus expectations by 5.4%. This shortfall was primarily due to weaker volumes in Mexico and the US and the impact of MXN depreciation. Volumes were further impacted by extraordinarily adverse weather conditions, resulting in a 4% YoY decline in consolidated Cement volumes, a 6% drop in Ready-mix volumes, and a 2% decrease in Aggregates volumes. Consolidated prices in local currencies rose between 1% and 2% YoY; however, MXN depreciation led to lower consolidated prices for Cement (-3% YoY in USD) and Ready-mix (-1%), while consolidated Aggregate prices increased 1% in US dollars.

Gross profit declined 10.1% YoY to $1.3 billion, with the gross margin contracting by 1.4 percentage points to 32.8% in 3Q24 from 34.1% in 3Q23, mainly due to higher fixed costs and reduced sales. The cost of goods sold fell 4.3% YoY to $2.8 billion, while the cost of sales as a percentage of revenues rose to 67.2% in 3Q24 from 65.9% in 3Q23.

In 3Q24, adjusted EBITDA decreased by 13.2% YoY (l-t-l: -9%) to $746.7 million from $861.1 million in 3Q23, coming in 8.9% below consensus expectations. The EBITDA margin contracted to 18.3% from 19.7% over the same period. EBITDA was primarily impacted by lower performance across most regions, except Europe, and decreased profitability in Mexico and SCAC. Cemex estimates that adverse weather conditions contributed approximately $33 million to the EBITDA decline.

Mexican construction fundamentals remained relatively healthy in 3Q24 compared to historical figures, though they were significantly pressured relative to 3Q23. Mexican construction spending declined by 0.9%, 7.5%, and 13.1% in July, August, and September, respectively. In September 2024, the Mexican construction business confidence index fell below 50, indicating contraction territory at 48. However, the Mexican construction activity index remained robust, at 113 and 114 in July and August. Regarding macroeconomic indicators, Mexico’s GDP per capita is projected to grow modestly by 1.5% in 2024, 1.4% in 2025, and 2.0% in 2026. The fiscal deficit is expected to be significant at -5.2% in 2024, improving to -3.9% in 2025 and -3.4% in 2026.

Looking ahead, we anticipate positive results in 2025, driven by favorable demand factors, including robust infrastructure and housing spending in Mexico, supported by nearshoring and increasing demand for infrastructure in the US, as only half of the IIJA funding has been allocated to date. Mexico’s new government agenda, emphasizing housing and infrastructure, should benefit Cemex as a leading global cement producer and a dominant player in the profitable Mexican market. The government has announced plans to build 1 million homes over the next six years and develop ten economic corridors nationwide to capitalize on nearshoring opportunities.

Strategy

Cemex is advancing its growth-oriented portfolio optimization by executing strategic divestments, particularly in selected Emerging Markets, to streamline its holdings and drive further investment in the US, Mexico, and Europe, primarily through bolt-on opportunities. During the year, Cemex announced non-core asset divestitures totaling $2.2 billion. With the completion of these transactions, approximately 90% of the company’s EBITDA will be generated in the US, Mexico, and Europe. We also anticipate that proceeds from these divestments will support Cemex’s growth strategy, which was launched in 2019, with a primary focus on the US.

These divestments include $800 million in the Philippines, $950 million in the Dominican Republic, $200 million in Guatemala, and $209 million from the remaining minority stake in Neoris. Cemex completed the asset sale in Guatemala in 3Q24, and the other divestments are expected to close by year-end or shortly thereafter.

3Q24 Segment Results

Mexico

Mexico revenue (31% of LTM total revenue) declined significantly by 16.5% YoY (l-t-l: -5%) to $1.1 billion in 3Q24, primarily due to weak volumes and lower US Dollar prices. The revenue decline was driven by US Dollar price decreases in Cement (-9% YoY), Ready-mix (-8%), and Aggregates (-15%), along with volume reductions in Cement (-7%), Ready-mix (-4%), and Aggregates (-7%). Volumes were impacted by reduced construction activity following the June election and adverse weather, with precipitation levels 50% higher than in the same quarter in 2023. Regarding local currency pricing, Cement and Ready-mix increased by 3% and 5% during the quarter, though unfavorable currency movements offset this. EBITDA generated in Mexico decreased by 19.9% (l-t-l: -8%) to $319 million in 3Q24, down from $399 million in 3Q23, with the EBITDA margin contracting by 1.2 percentage points to 28.1% from 29.3%. EBITDA was primarily constrained by a 30% temporary increase in electricity costs, which Cemex expects to reverse in 2025 as operations transition to more competitive power sources. The company estimates that adverse weather impacted EBITDA by around $8 million.

Cemex continues to see healthy growth in its ready-mix order book for projects related to nearshoring and infrastructure. Over the medium term, the company remains optimistic about Mexico’s growth prospects, as the new government’s agenda appears supportive of housing and infrastructure. Cemex has reduced its 2024 volume guidance for Mexico, now expecting flat cement volumes for the year, compared to prior expectations of a low- to mid-single-digit increase in 2Q24. However, Cemex has maintained its 2024 guidance for Ready-mix volumes, expecting a low- to mid-single-digit increase, and Aggregates volumes, expecting a low-single-digit increase.

USA

United States revenue (31% of LTM total revenues) declined by 4.2% YoY to $1.3 billion in 3Q24, primarily due to lower volumes, partially offset by higher prices. Cement, Ready-mix, and Aggregates volumes decreased by 6%, 11%, and 1%, respectively, with Cement and Ready-mix volumes particularly impacted by adverse weather conditions, including three major hurricanes, above-average precipitation, and flooding. Key markets experienced 50% to 200% higher precipitation than in 2Q23. During the quarter, prices increased across the board, with Cement up 2% YoY, Ready-mix up 3%, and Aggregates up 3%. In line with the revenue decline, US EBITDA decreased by 3.9% to $258 million in 3Q24 from $268 million in 3Q23. The EBITDA margin remained relatively stable at 19.3%, supported by higher prices, reduced imports, deceleration in energy costs, and Cemex’s operational optimization efforts. Cemex estimates that adverse weather reduced US EBITDA by approximately $17 million, contributing to the quarterly decline.

Aggregates became the most significant contributor to US EBITDA, accounting for 36% YTD with margins above 30%. During the quarter, Cemex formed a joint venture with Couch Aggregates to strengthen and expand its aggregates reserves in the Southeast. The company expects improved conditions in 2025, supported by infrastructure demand, more robust housing activity, and stabilization in the commercial sector. Cemex’s 2024 US volume guidance was revised downward. Cemex now expects Cement volumes in the US to decrease mid-single digits from prior low-single-digit expectations, Ready-mix volumes to decline in the double digits vs. previous mid-single-digit expectations, and Aggregates volumes to decrease in the low single digits compared to prior flat expectations.

EMEA

3Q24 EMEA revenue was $1.2 billion, up 1.2% YoY, primarily driven by a 3.8% YoY increase in European revenue to $970 million. Prices remained stable across Cemex’s European businesses, with Ready-mix volumes down 4% YoY, Cement volumes up 2%, and Aggregates volumes flat. The improvement in European volumes was attributed to stronger economic activity, lower interest rates, and lifting the construction ban related to the Paris Olympics. This growth in Europe offset a 6.9% YoY revenue decline in MEA, bringing MEA revenue to $273 million in 3Q24. EMEA EBITDA remained steady at $201 million in 3Q24, with the EBITDA margin contracting slightly by 0.2 percentage points to 16.2%. EBITDA generated in Europe increased by 1.3% YoY to $164 million, although the European EBITDA margin declined by 0.4 percentage points to 16.9% from 17.3% in 3Q23. Cemex believes it is experiencing an inflection point, as it recorded volume growth for the first time in nine quarters. Europe’s EBITDA was supported by decelerating costs, particularly in energy for cement production.

SCAC

SCAC revenue decreased by 2.4% YoY to $311 million in 3Q24 from $319 million in 3Q23, primarily due to lower volumes that offset solid price increases. Volume declines were observed across Cement (-3% YoY), Ready-mix (-2%), and Aggregates (-6%), offsetting price increases in Cement (+1% YoY in USD), Ready-mix (+7%), and Aggregates (+5%). SCAC EBITDA dropped 27.3% YoY to $48 million in 3Q24, with the EBITDA margin contracting by 5.3 percentage points to 15.4% from 20.8%. Lower volumes, mainly impacted by two hurricanes and a transportation strike in Colombia, constrained EBITDA, with Cemex estimating a $7 million impact.

In 3Q24, Cemex announced the sale of its Dominican Republic and Guatemala operations. The company expects the Dominican Republic transaction to close by year-end, while the Guatemala transaction closed in September 2024. Consequently, these two businesses were reclassified as discontinued operations.

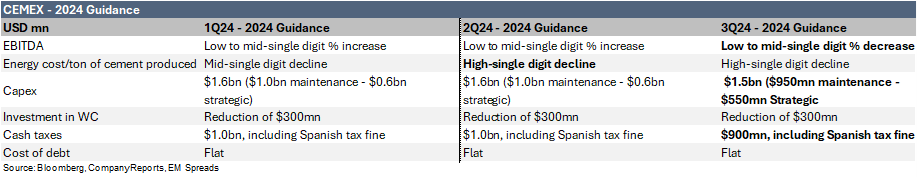

2024 Guidance

In the third quarter of 2024, Cemex's management revised its consolidated guidance, as highlighted in the table below:

Cemex’s management updated its 2024 volume guidance, lowering expectations. Cement volumes are now expected to see a low-single-digit decline, revised from prior guidance of flat to low-single-digit growth. Ready-mix volumes are forecasted to decline by mid-single digits, down from a low-single-digit decline. Aggregates volumes are anticipated to experience a low-single-digit decline, revised from expectations of flat to low-single-digit growth.

Financial Profile

Cemex ended 3Q24 with $10.1 billion in total reported debt, up modestly by $60.8 million sequentially (December 2023: $8.2 billion). Our total reported debt includes $1.2 billion in leasing obligations as of September 2024 and 100% of the two perpetual hybrid subordinated bonds totaling $2.0 billion. As of September 2024, $1.5 billion of the reported debt was short-term, with an additional $271 million in short-term leasing obligations. Cash and cash equivalents stood at $697.4 million as of September 2024, down slightly from $704.9 million in June 2024 (December 2023: $623.9 million). Consequently, net debt increased by $68.3 million sequentially to $9.4 billion as of September 2024, up significantly from $7.5 billion as of December 2023.

We note that credit rating agencies classify the subordinated bonds as 50% equity and 50% debt, primarily due to their subordinated status, seniority only to share capital, and the issuer’s discretion to defer coupon payments.

The adjusted EBITDA of $746.7 million comfortably covered $314.8 million in capex and $93.3 million in interest expense, resulting in $338.6 million of free cash flow (3Q23: $470.5 million). After accounting for -$63.0 million in working capital changes, -$352.9 million in taxes, -$8.5 million from asset sales, $134.6 million net from acquisitions/divestments (including the $200 million Guatemala divestment), and -$29.9 million in dividends, net free cash flow totaled $65.8 million (3Q23: $453.5 million).

Funds from operations (adjusted EBITDA minus cash interest paid and cash taxes paid) were $170.7 million in 3Q24, down significantly from $505.6 million in 3Q23 (2Q24: $535.1 million). Adjusted EBITDA comfortably covered $223.1 million in cash interest paid, including $30 million of interest on Cemex’s subordinated debt and $352.9 million in cash taxes paid.

Free operating cash flow (cash from operations minus capex) was $8.1 million in the quarter, significantly down from $388.7 million in 3Q23 (2Q24: $244.9 million). Cash from operations was $322.9 million in 3Q24, down from $693.7 million in the same quarter in 2023 (2Q24: $535.2 million). Capex was $314.8 million in 3Q24, up from $305.0 million in 3Q23.

In 2Q24, Cemex initiated its dividend program, planning equal quarterly distributions totaling approximately $120 million in the first year. The first payment of $30.1 million was made in 2Q24, followed by a second payment of $29.9 million in 3Q24.

Liquidity

Cemex’s liquidity remains healthy. The company has $1.7 million in short-term debt, including factoring and operating leases, covered by total liquidity of $2.6 billion, which includes $422.3 million in cash, $275.2 million in short-term investments, and $1.9 billion in revolver availability. As of September 2024, Cemex’s liquidity covered its short-term debt by 1.5x, providing a protective buffer in a cyclical industry.

Cemex hedges approximately three-quarters of its emerging market currency exposure, primarily the Mexican peso, with forward positions extending up to 24 months. The CFO recently noted that these hedges allow the company to manage scenarios from ~10% appreciation to ~40% peso depreciation. Additionally, Cemex hedges close to 80% of its energy exposure, including electricity, transportation fuels, maritime shipping, and third-party transportation fuel costs. The company has also started hedging its petcoke position.

Cemex’s debt amortization profile is healthy, with no significant maturities until 2026. Management remains committed to strengthening its capital structure, aiming to reduce leverage by half a turn in the next 24–36 months.

As a result, key credit metrics were primarily impacted by lower EBITDA and higher cash interest paid:

Gross leverage increased to 3.1x as of September 2024 from 3.0x as of June 2024 (September 2023: 3.1x).

Net leverage was 2.9x as of September 2024 compared to 2.8x as of June 2024 (September 2023: 2.9x).

Adjusted EBITDA cash interest coverage deteriorated sequentially to 4.3x as of September 2024 from 4.9x as of June 2024 (September 2023: 5.0x).

FFO to debt decreased to 16.0% as of September 2024 from 19.4% as of June 2024 (September 2023: 20.5%)

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.