Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential

Monitoring tariff risks while maintaining a neutral stance on Cemex bonds.

Executive Summary

We maintain our Market Perform recommendation on Cemex. We continue to view Cemex as an attractive emerging market credit story, supported by credit-positive strategic priorities, a commitment to strengthening its credit profile, and healthy cash generation capacity. However, current spread levels appear fair and do not offer an attractive entry point, particularly given the potential risk of U.S. tariffs on Mexican imports, which could significantly impact the broader Mexican economy. That said, spreads may be more appealing to investors who see tariff concerns as overstated or unlikely to materialize. We would keep the name on our watchlist for potential investment should this risk of U.S. tariffs subside.

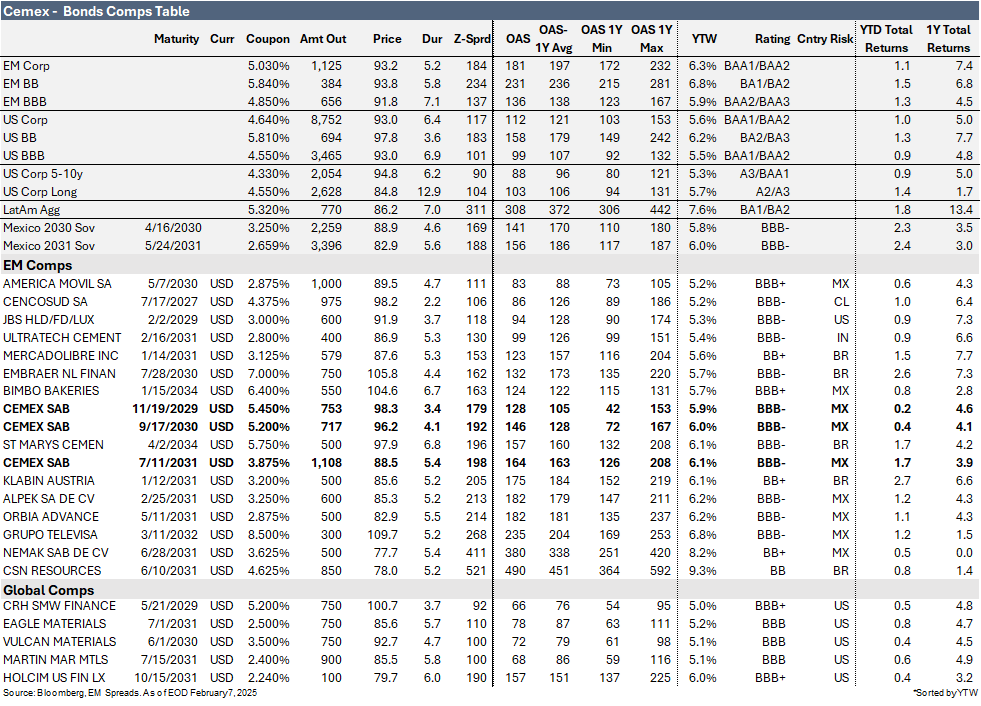

Within Cemex’s capital structure, we prefer the CEMEX (BBB-/BBB-) 5.20% 2030 notes, which trade wider than the Mexican sovereign, the EM BBB index, and comparable peers. However, we do not anticipate these notes to outperform in the near term.

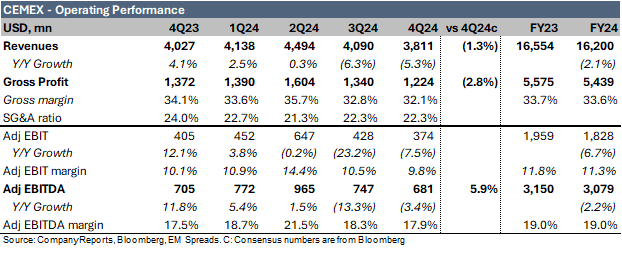

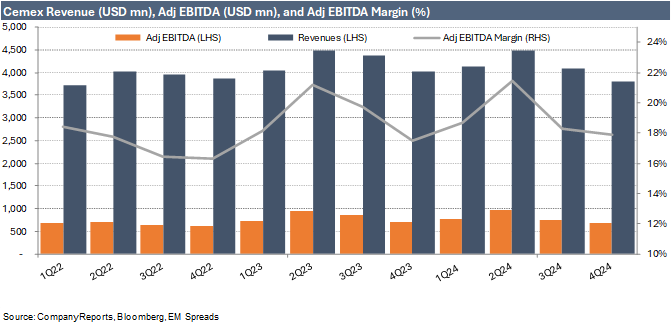

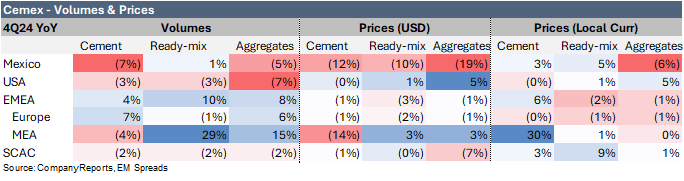

Solid 4Q24 EBITDA and Cash Generation. Cemex reported a 5.3% decline in 4Q24 revenue to $3.8 billion (l-t-l: 0%), missing consensus expectations by 1.3%. The shortfall was primarily due to weaker volumes in Mexico and the U.S., along with the impact of MXN depreciation on pricing. Adjusted EBITDA declined 3.4% YoY (l-t-l: +3%) to $681 million from $705 million in 4Q23 but exceeded consensus by 5.9%. The EBITDA margin expanded 36 bps to 17.9%.

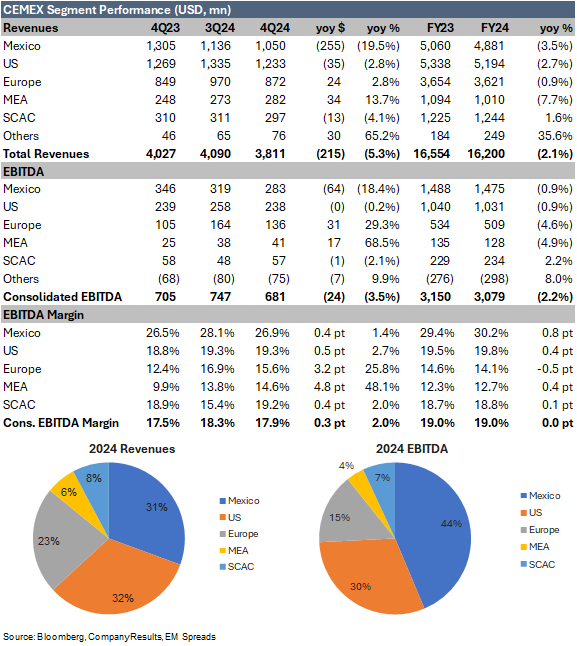

Mexico: Weaker Volumes and FX Headwinds. 4Q24 revenue declined 19.5% YoY (l-t-l: -6%) to $1.1 billion, while EBITDA fell 18.4% (l-t-l: -4%) to $283 million. Despite a 38 bps EBITDA margin expansion to 26.9%, supported by favorable price/cost dynamics, operations were impacted by weaker volumes and lower US Dollar prices, partially offset by higher local currency prices.

U.S.: Lower Volumes, Stronger Margins. 4Q24 revenue declined 2.8% YoY to $1.2 billion, while EBITDA fell marginally by 0.2% to $238 million. The top line was pressured by weaker volumes, though partially offset by higher prices. However, the EBITDA margin expanded 50 bps to 19.3%, supported by price increases, reduced imports, lower energy costs, and operational optimization efforts.

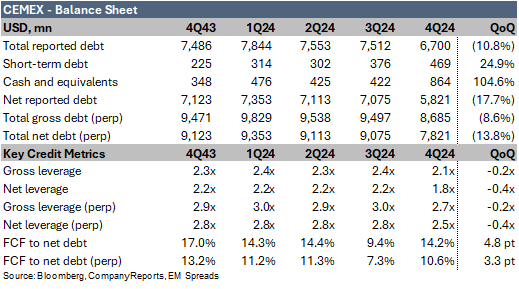

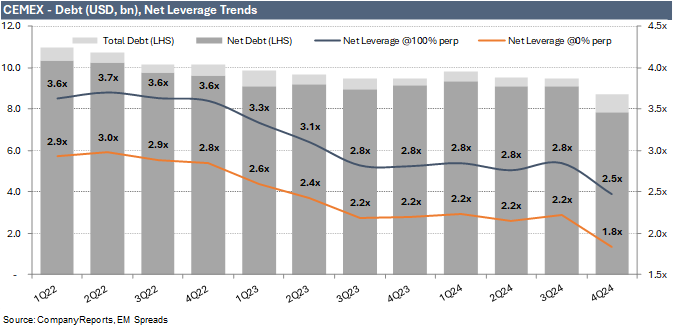

Lower Debt and Leverage Improvement. Cemex ended 4Q24 with $8.7 billion in total debt, including perpetual bonds, down $812 million sequentially. Net debt declined significantly by $1.25 billion to $7.8 billion. Gross leverage, including perpetual bonds, improved by 0.2x to 2.7x as of December 2024, while net leverage fell 0.4x to 2.5x.

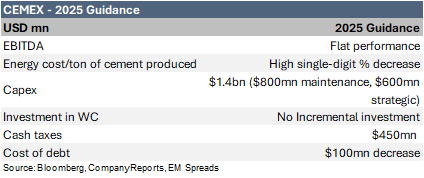

2025 Outlook: Stable EBITDA, Higher Free Cash Flow. Cemex expects EBITDA of approximately $3.1 billion and capex of around $1.4 billion. Taxes should decline significantly following the 2024 Spanish tax fine payment, while debt costs are projected to be $100 million lower. As a result, net free cash flow is expected to reach $736 million, excluding M&A and asset sales, while adjusted net free cash flow, accounting for dividends and subordinated perpetual bond interest, is projected at $473 million, up from $146 million in 2024.

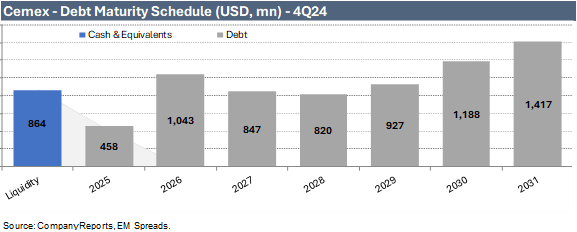

Strong Liquidity Position. As of December 2024, Cemex’s liquidity covered short-term debt by 6.8x, providing a substantial buffer in a cyclical industry. Liquidity is expected to strengthen further in 1Q25 with the receipt of $950 million in proceeds from the Dominican Republic asset divestment.

U.S. Tariff Risk to Mexican Operations. U.S. tariffs on Mexican imports could pressure Cemex’s domestic operations, with Mexico accounting for 44% of its 2024 EBITDA. Tariffs could weaken its domestic business and deteriorating credit metrics, particularly given Cemex’s reliance on infrastructure and housing growth, supported by nearshoring and government-led initiatives, which may face delays or cutbacks if economic conditions worsen.

Trade Recommendation

We continue to view Cemex as an attractive emerging market credit story but maintain a Market Perform recommendation. Cemex reported solid 4Q24 results, with healthy EBITDA and cash generation. The company expects 2025 volumes to increase in the low-single digits for Cement and Ready-Mix, while Aggregates is projected to remain stable. This outlook is supported by growth across all regions except Mexico, where conditions remain challenging. A recovery in the U.S. and Europe should help offset ongoing headwinds in Mexico, which are somewhat to be expected in the first year of the new administration. As a result, Cemex guided for flat 2025 EBITDA at around $3.1 billion but anticipates strong free cash flow, supported by lower taxes, reduced capex, and declining interest expenses.

However, macroeconomic uncertainties in Mexico, including a widening fiscal deficit, weak GDP growth of around 1%, exposure to uncertain U.S.-Mexico relations, and foreign exchange risk, add pressure to the credit story. Additionally, potential U.S. tariffs could weigh on Cemex’s credit profile, not due to the direct impact on its exports, which are minimal, but because of broader repercussions on the Mexican economy, limiting the potential for outperformance.

That said, Cemex has maintained a disciplined financial strategy, steadily improving its credit metrics while remaining committed to its 1.5x leverage target over the next two years. Strong cash generation, financial flexibility, and ample liquidity support this approach. Liquidity should further improve in 1Q25 following the $950 million proceeds from the Dominican Republic asset divestment. We expect Cemex to maintain this trajectory and believe it could evolve into a mid-BBB credit over the medium term. The company will likely continue strengthening its balance sheet and credit profile, backed by solid cash generation and improving market conditions in key regions. Additionally, management announced a cost-cutting program that could generate approximately $150 million in EBITDA savings in 2025

Within Cemex’s capital structure, we prefer the CEMEX (BBB-/BBB-) 5.20% 2030 notes, which trade wider than the Mexican sovereign, the EM BBB index, and comparable peers. However, we do not expect these notes to outperform in the near term, as we find the CEMEX 2030 notes yielding 6.0% for a 4.1-year duration only modestly attractive at current spread levels.

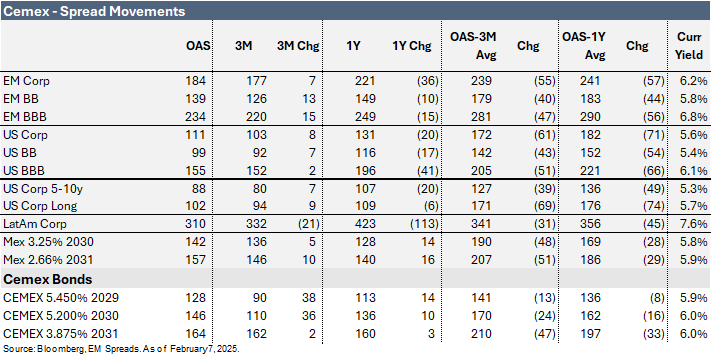

The notes have widened by 36 bps over the past three months to 146 bps from 110 bps, with an even more pronounced widening since our 3Q24 report, when they were trading around 85 bps. At the time, we noted that the bonds no longer appeared compelling. Since then, market conditions have shifted, and we now view current spread levels as fair, without presenting a particularly attractive entry point. The potential for U.S. tariffs on Mexican imports remains a key risk, as such measures could significantly impact the broader Mexican economy, pressuring Mexican assets.

Current spreads may appear more attractive for investors who believe the tariff concerns are overstated and unlikely to materialize. For comparison, the broader EM BBB Index yields 5.9%, the U.S. BBB Index yields 5.6%, and Mexican sovereign bonds maturing in 2030 yield 5.9%. Current yields also compare favorably to BBB- rated peers, including JBSBZ (Baa3/BBB-/BBB-) 3.00% 2029 notes yielding 5.3% for a 3.7-year duration, UTCMIN (Baa3/BBB-) 2.80% 2031 bonds yielding 5.4% for a 5.3-year duration, and VOTORA (Baa3/BBB/BBB-) 5.75% 2034 notes yielding 6.1% for a 6.8-year duration.

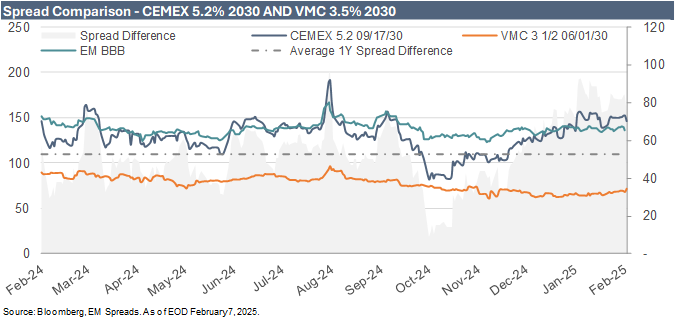

Given Cemex’s significant and growing exposure to the U.S. and Europe, we find it useful to analyze Cemex’s bonds relative to the U.S. market and its U.S. peers. The spread difference between CEMEX 2030 notes, trading at 146 bps, and VMC 3.5% 2030 notes, trading at 71 bps, stands at 75 bps, well above the one-year average of 53 bps. Notably, this spread difference was as low as 9 bps in early October, significantly below current levels.

Absent the current uncertainty surrounding potential U.S. tariffs, we would view these spread levels as attractive for U.S. investors. However, given the broader risks posed by a potentially disruptive trade environment, we believe Cemex’s risk/reward profile is skewed to the downside. As a result, we do not see an attractive entry point for CEMEX bonds at this time. That said, we would keep the name on our watchlist for potential investment should U.S.-Mexico relations improve, and the risk of tariffs subside.

4Q24 Operating Performance

Cemex reported a 5.3% decline in 4Q24 revenues to $3.8 billion (l-t-l: 0%), missing consensus expectations by 1.3%. The shortfall was primarily driven by weaker volumes in Mexico and the U.S., along with the impact of MXN depreciation against the U.S. dollar on USD-denominated prices. For 2024, revenues fell 2.1% to $16.2 billion (l-t-l: -1%).

Gross profit declined 10.8% YoY to $1.2 billion, with the gross margin contracting by 20 bps to 32.1% in 4Q24 from 34.1% in 4Q23, largely due to higher fixed costs and lower sales. The cost of goods sold fell 2.5% YoY to $2.6 billion, but as a percentage of revenues, it rose to 67.9% in 4Q24 from 65.9% in 4Q23.

Adjusted EBITDA declined 3.4% YoY (l-t-l: +3%) to $681 million in 4Q24 from $705 million in 4Q23 but came in 5.9% above consensus expectations. The EBITDA margin expanded to 17.9% from 17.5% over the same period. Weak results in Mexico were largely offset by strong EBITDA generation in EMEA and SCAC, while the U.S. remained relatively flat. With prices more than offsetting costs, the decline was primarily volume-driven. The like-for-like improvement was mainly supported by higher prices, stabilizing volumes in most markets, and a favorable fuel cost environment. In 2024, EBITDA declined 2.2% YoY (l-t-l: -1%) to $3.1 billion, with the EBITDA margin remaining flat at 19.0%, in line with Cemex’s guidance of a low-single-digit decline.

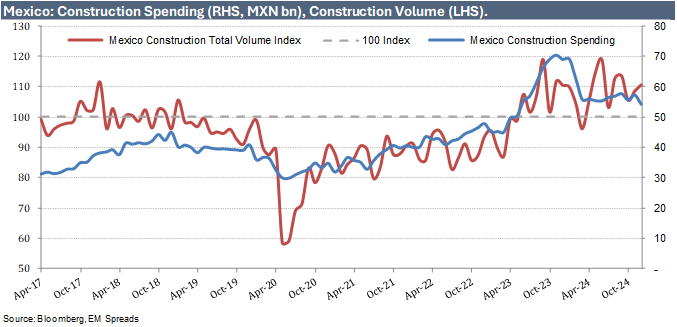

Fundamentals in Mexico remained relatively healthy in October and November compared to historical figures, though they weakened significantly relative to the same period in 2023. Mexican construction spending declined 19.5% YoY in October, 18.7% in November, and 21.5% in December. On a month-over-month basis, the construction spending index fell 3.6% in October, rebounded 3.0% in November, and then declined 5.4% in December.

We see a slower construction pace as the new government establishes its agenda and implements policy changes, alongside geopolitical uncertainty surrounding Trump’s presidency and its policies toward Mexico. In September 2024, the Mexican construction business confidence index fell below 50, signaling contraction at 48, improving only slightly to 49 in October, November, and December. Meanwhile, the Mexican construction activity index remained in expansion territory, above 100, at 109 in October and 111 in November, though well below the 119 recorded in May 2024.

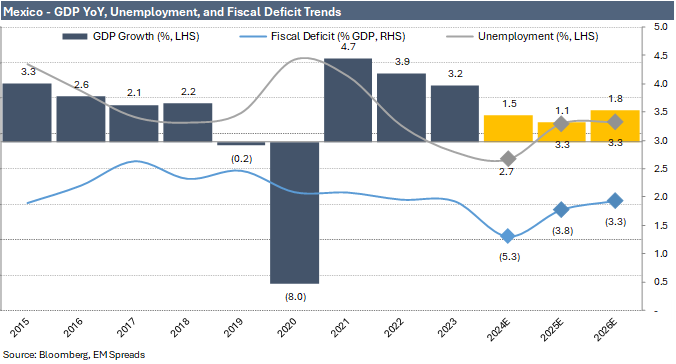

Regarding macroeconomic indicators, Mexico's GDP per capita is projected to grow modestly, increasing by 1.5% in 2024, 1.1% in 2025, and 1.8% in 2026. Uncertainty surrounding the trade and immigration policies of Trump’s presidency could exert significant pressure on Mexico’s economy, particularly as these policies take time to be implemented. This uncertainty is likely to weigh on investment and growth in 2025 for as long as it persists.

Unemployment is expected to rise modestly from 2.8% in 2024 to 3.3% in 2025 before slightly declining to 3.2% in 2026. Meanwhile, the fiscal deficit is projected to remain substantial at -5.4% of GDP in 2024 but improve to -3.8% in 2025 and -3.4% in 2026.

Looking ahead, construction activity in Mexico is expected to be slower than previously anticipated in early 2025. However, robust infrastructure and housing spending should gain momentum, supported by nearshoring trends and increasing infrastructure demand in the U.S., where a significant portion of Infrastructure Investment and Jobs Act (IIJA) funding remains unallocated. Mexico’s new government agenda, which prioritizes housing and infrastructure development, should benefit Cemex as a leading global cement producer and a dominant player in the profitable Mexican market. The government has announced plans to build one million homes over the next six years and develop ten economic corridors nationwide to capitalize on nearshoring opportunities.

Our Take on Potential U.S. Tariffs

While U.S. tariffs would not significantly impact Cemex’s exports from Mexico to the U.S., the company has sizeable operations within the U.S. and exports only a small portion of its output. However, the broader economic consequences of tariffs on Mexico, including potential currency depreciation and a recession, could weigh more heavily on Cemex’s domestic operations. This is particularly relevant given that 44% of its 2024 EBITDA was generated in Mexico.

Despite these risks, Cemex’s credit-positive strategic priorities, commitment to strengthening its credit profile, end-market diversification, solid credit metrics, and ample liquidity provide some reassurance in its ability to navigate tariff uncertainty. However, if the U.S. imposes tariffs on Mexico, we expect a meaningful negative impact on Cemex’s domestic operations, leading to a deterioration in credit metrics.

This risk is further amplified by the fact that much of the positive outlook for Cemex is based on expectations of strong infrastructure and housing spending in Mexico, supported in part by nearshoring and government-led investment. If tariffs trigger a sharp economic slowdown, many of these initiatives could be delayed or scaled back, exacerbating the negative impact on Cemex’s domestic performance and credit profile.

4Q24 Segment Results

Mexico

Mexico revenue (31% of 2024 total revenue) declined significantly by 19.5% YoY (l-t-l: -6%) to $1.1 billion in 4Q24, primarily due to weaker volumes and lower US Dollar prices, while local currency prices increased. The revenue decline was driven by substantial US Dollar price reductions in Cement (-12% YoY), Ready-mix (-10%), and Aggregates (-19%), along with volume declines in Cement (-7%) and Aggregates (-5%). This was partially offset by a modest 1% increase in Ready-mix volumes. The volume contraction was primarily attributed to reduced construction activity following the June Mexican presidential election. In local currency terms, Cement and Ready-mix prices rose by 3% and 5%, respectively, while Aggregates prices declined by 6%. Improved local currency pricing was offset by a 14.3% YoY depreciation of the Mexican Peso against the US Dollar.

EBITDA in Mexico decreased by 18.4% YoY (l-t-l: -4%) to $283 million in 4Q24, down from $346 million in 4Q23, though the EBITDA margin expanded by 38 bps to 26.9% from 26.5%, supported by positive price/cost dynamics. For FY24, EBITDA declined 0.9% YoY (l-t-l: +3%), with the EBITDA margin expanding 81 bps to 30.2%. Currency depreciation, which averaged 3% in 2024, had a $52 million impact on EBITDA.

For 2025, Cemex anticipates a year of two distinct halves, with a challenging volume comparison base and FX headwinds in the first half. Over the medium term, the company remains optimistic about Mexico’s growth prospects, as the new government’s agenda supports housing and infrastructure spending. Cemex’s 2025 volume guidance for Mexico expects Cement volumes to decline in the low to mid-single digits, Ready-mix to decrease in the mid-single digits, and Aggregates to remain flat.

USA

United States revenue (32% of 2024 total revenue) declined 2.8% YoY to $1.2 billion in 4Q24, primarily due to lower volumes, partially offset by higher prices. The revenue decline was mainly driven by volume reductions of 3% in Cement, 3% in Ready-mix, and 7% in Aggregates. This was partially mitigated by a 1% increase in US Dollar pricing for Ready-mix and a 5% improvement in Aggregates, while Cement prices remained stable compared to 4Q23.

US EBITDA declined marginally by 0.2% to $238 million in 4Q24, though the EBITDA margin expanded 50 bps to 19.3% from 18.8%. Margin expansion was supported by higher prices, reduced imports, lower energy costs, and Cemex’s operational optimization efforts. For FY24, US EBITDA declined 0.9% YoY, with the EBITDA margin expanding 36 bps to 19.8%. The EBITDA decline was largely attributed to adverse weather conditions, which Cemex estimated had a $38 million impact in 2024.

For 2025, Cemex expects improved market conditions, driven by infrastructure demand as transportation projects under the Infrastructure Investment and Jobs Act continue to roll out, along with strong investment in the industrial sector, particularly manufacturing. Cemex’s 2025 volume guidance for the US projects Cement volumes to increase in the low-single digits, Ready-mix to improve in the low-single digits, and Aggregates to decline in the low-single digits.

EMEA

4Q24 EMEA revenue increased 5.3% YoY (l-t-l: +8%) to $1.2 billion, driven by a 13.7% YoY rise in MEA to $282 million and a 2.8% improvement in Europe to $872 million. The revenue growth was primarily supported by higher volumes in Cement (+4% YoY), Ready-mix (+10%), and Aggregates (+8%), partially offset by lower US Dollar prices in Cement (-1%), Ready-mix (-3%), and Aggregates (-1%). In Europe, volume growth was broad-based, with Eastern Europe serving as the primary driver due to EU-funded infrastructure spending, while Western Europe showed early signs of recovery.

EMEA EBITDA rose significantly to $177 million in 4Q24 from $130 million in 4Q23, up 36.7% YoY (l-t-l: +43%), with the EBITDA margin expanding to 15.4% from 11.8%. Margin expansion was supported by higher volumes, operational leverage, and a one-off adjustment in the company’s UK operations. In Europe, EBITDA increased 29.3% YoY to $136 million, with the EBITDA margin improving to 15.6% from 12.4%. MEA EBITDA rose sharply to $41 million in 4Q24 from $25 million in 4Q23, with the EBITDA margin expanding to 14.6% from 9.9%. However, FY24 EMEA EBITDA declined 4.7% YoY (l-t-l: -3%) to $637 million, with the EBITDA margin contracting by 32 bps to 13.8%.

For 2025, Cemex expects continued EMEA volume recovery, supported by improved European construction activity. Cemex’s 2025 volume guidance for EMEA projects Cement volumes to grow in the low-single digits, Ready-mix to increase in the low-single digits, and Aggregates to remain flat.

SCAC

SCAC revenue declined 4.1% YoY (l-t-l: 0%) to $297 million in 4Q24 from $310 million in 4Q23, primarily due to lower volumes and weaker US Dollar pricing. Volume declines were observed across Cement (-2% YoY), Ready-mix (-2%), and Aggregates (-2%), alongside US Dollar price reductions in Cement (-1% YoY), Ready-mix (0%), and Aggregates (-7%).

SCAC EBITDA decreased 2.1% YoY (l-t-l: +2%) to $57 million in 4Q24, though the EBITDA margin expanded by 38 bps to 19.2% from 18.9%. Demand in the region continues to be driven by the formal sector, supported by large infrastructure projects such as the Bogotá Metro—where Cemex secured more than 80% of total volumes—and the fourth bridge over the Panama Canal. The Urbanization Solutions business is expanding rapidly in the region, posting record Operating EBITDA growth of 36% in 2024, with a 5.3pp margin expansion.

For 2025, Cemex’s volume guidance for SCAC projects Cement volumes to increase in the mid-single digits and Ready-mix to improve in the low-double digits, while no guidance was provided for Aggregates.

2025 Guidance

Cemex's management presented its consolidated 2025 guidance, as highlighted in the table below:

Financial Profile

Cemex ended 4Q24 with total reported debt of $6.7 billion, a significant $812 million reduction sequentially (December 2023: $7.5 billion). Including perpetual bonds, total debt stood at $8.7 billion as of December 2024. Cash and cash equivalents rose to $864 million, up $442 million QoQ (December 2023: $348 million). As a result, net reported debt declined significantly by $1.3 billion to $5.8 billion, while net reported debt, including perpetual bonds, decreased to $7.8 billion as of December 2024 from $9.1 billion in September 2024 (December 2023: $9.1 billion).

Credit rating agencies classify the subordinated bonds as 50% equity and 50% debt, given their subordinated status, seniority only to share capital, and the issuer’s discretion to defer coupon payments. However, this classification could change if an agency reviews its methodology.

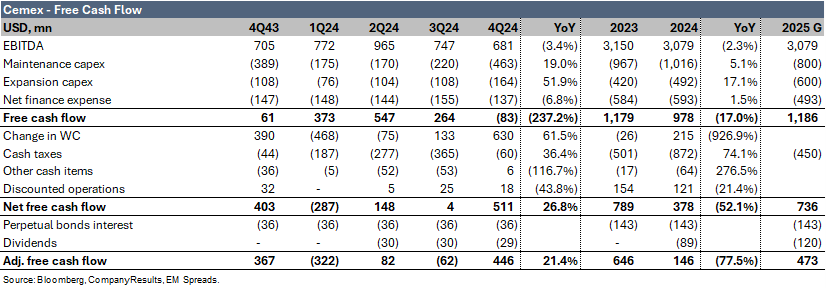

4Q24 EBITDA of $681 million did not fully cover $463 million in maintenance capex, $164 million in expansion capex, and $137 million in net finance expenses, resulting in a free cash outflow of $83 million. After accounting for a $630 million working capital inflow, $60 million in taxes, $6 million in other cash items, and $18 million from discontinued operations, net free cash flow totaled $511 million in the quarter. This represents an improvement from 4Q23, when Cemex generated $403 million in net free cash flow, primarily due to a working capital release.

However, the full-year 2024 net free cash flow of $378 million was significantly lower than the $789 million recorded in 2023. The decline was primarily driven by higher tax payments, which rose from $501 million in 2023 to $872 million in 2024, impacted by a $380 million tax fine in Spain.

Compared to Cemex’s reported free cash flow, our adjusted free cash flow calculation includes dividend payments and interest payments on subordinated perpetual bonds. On this basis, adjusted free cash flow increased 21.4% YoY to $446 million in 4Q24, up from $367 million in 4Q23. However, for full-year 2024, adjusted free cash flow declined significantly to $146 million from $646 million in 2023.

In 2Q24, Cemex initiated its dividend program, planning equal quarterly distributions totaling approximately $120 million in its first year. The company made its first payment of $30.1 million in 2Q24, followed by a second payment of $29.9 million in 3Q24 and a third payment of $29.4 million in 4Q24, bringing total dividends paid in 2024 to $89.4 million. We expect dividend payments to increase in 2025 as the company approaches its leverage target of 1.5x, down from 1.8x as of December 2024. However, Cemex’s management reiterated that capital allocation priorities focus first on growth investments, then deleveraging, and then shareholder returns.

For 2025, the company guided for stable EBITDA of approximately $3.1 billion and capex of around $1.4 billion, comprising $800 million in maintenance capex and the remaining $600 million in strategic/expansion capex. Taxes are expected to decline significantly as the Spanish tax fine was paid in 2024, while the cost of debt is projected to be around $100 million lower. As a result, net free cash flow is expected to reach approximately $736 million, excluding M&A activity. When accounting for dividends and interest payments on subordinated perpetual bonds, adjusted net free cash flow is projected to be around $473 million in 2025.

Liquidity

Cemex’s liquidity remains strong. As of December 2024, the company had $458 million in short-term debt, including lease liabilities, representing 53.1% of its cash position and 6.8% of total reported debt. Total liquidity stood at $3.2 billion, comprising $864 million in cash and cash equivalents and approximately $2.3 billion in committed revolver availability. Cemex’s liquidity covered its short-term debt by 6.8x, providing a substantial buffer in a cyclical industry. Liquidity is expected to improve further in 1Q25 as the company receives proceeds from the $950 million divestment of its Dominican Republic assets.

Cemex’s debt amortization profile remains healthy, with no significant maturities until 2026. Management remains committed to strengthening the capital structure, targeting a leverage reduction of half a turn over the next 24 months.

Cemex hedges approximately three-quarters of its emerging market currency exposure, primarily the Mexican peso, through forward positions extending up to 24 months. According to the CFO, these hedges enable the company to manage scenarios ranging from ~10% peso appreciation to ~40% depreciation. For 2025, Cemex has hedged nearly 70% of its energy exposure, covering electricity, transportation fuels, maritime shipping, and third-party transportation fuel costs. Additionally, the company has begun hedging its petcoke position.

Key Credit Metrics

Gross leverage decreased to 2.7x as of December 2024 from 3.0x as of September 2024 (December 2023: 2.9x).

Net leverage was 2.5x as of December 2024 compared to 2.8x as of September 2024 (December 2023: 2.8x).

Gross leverage, excluding perpetual bonds, declined to 2.1x from 2.4x sequentially (December 2023: 2.3x).

Net leverage, excluding perpetual bonds, improved to 1.8x as of December 2024 from 2.2x as of September 2024 (December 2023: 2.2x).

FCF to net debt improved to 10.6% as of December 2024 from 7.3% as of September 2024 (December 2023: 13.2%).

FCF to net debt, excluding the perpetual bonds, improved to 14.2% as of December 2024 from 9.4% as of September 2024 (December 2023: 17.0%).

See Also:

Cemex 2Q24: Solid Performance in Mexico Offsets Softness in the US

Cemex: The Promising Credit Story of a Regional Leader in the Cement Industry

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.