PEMEX 3Q24: Government Support Continues to Strengthen

We maintain our Outperform recommendation on PEMEX

Executive Summary

We maintain our Outperform recommendation on PEMEX. We believe that PEMEX’s reclassification, stronger linkage to the sovereign, and its payment program to stabilize balances with suppliers and contractors will support further spread compression. However, current spread levels already reflect a more accurate valuation of the substantial support from the Mexican government.

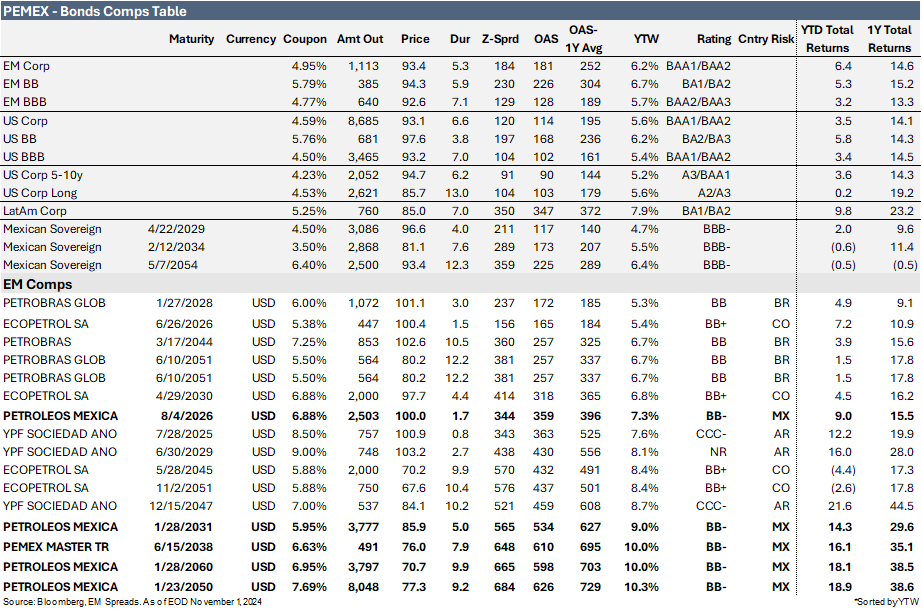

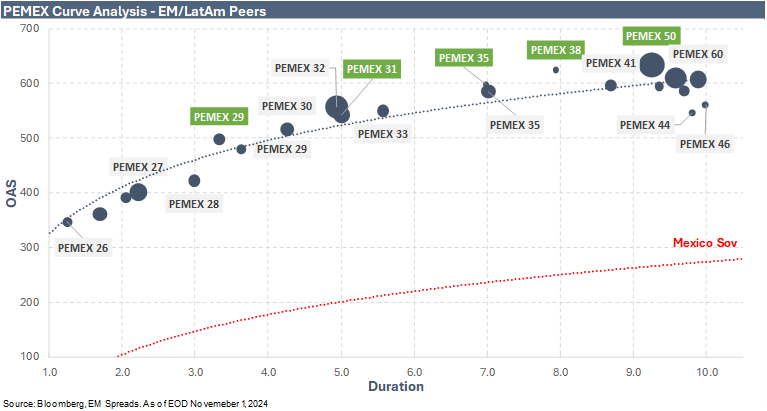

We find the PEMEX (B3/BBB/B+) 5.950% 2031, PEMEX 6.625% 2038, and PEMEX 7.690% 2050 bonds particularly attractive due to their yield pickup and the potential for a positive catalyst on the horizon. These bonds offer a favorable yield compared to sovereign bonds and are currently trading wider than the overall PEMEX curve. The spread pickup to the sovereign is more appealing at the belly and long end than at the shorter-dated notes, as most PEMEX bonds maturing before 2029 trade at or near par, limiting their upside potential.

3Q24 results continued to highlight PEMEX’s vulnerability and its significant reliance on government support. While the sequential EBITDA recovery and debt reduction were encouraging, these improvements were heavily dependent on substantial tax rebates and the absence of profit-sharing payments.

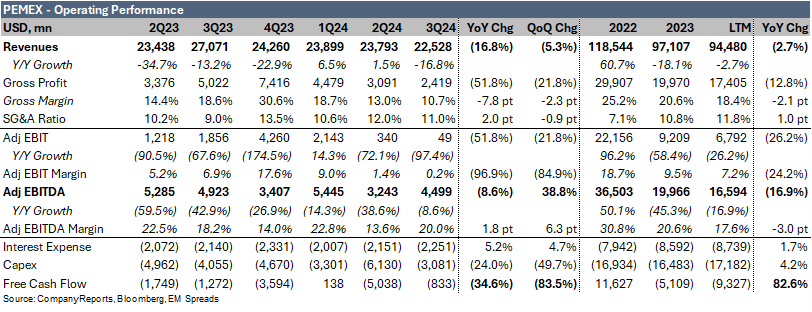

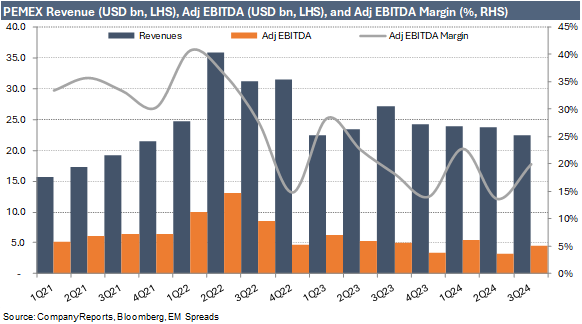

PEMEX’s 3Q24 revenues decreased significantly by 16.8% YoY (-7.7% in MXN) to $22.5 billion. Sequentially, revenues declined by 5.3% (+4.1% in MXN). Adjusted EBITDA for 3Q24 was $4.5 billion, down 8.6% YoY but marking a substantial 38.8% sequential improvement. The adjusted EBITDA margin expanded by 1.8 pp YoY and 6.3 pp QoQ to 20.0%.

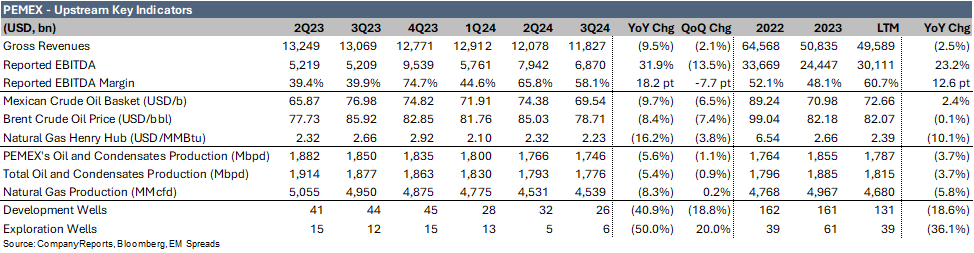

Upstream 3Q24 gross revenues declined by 9.5% YoY (+0.4% in MXN) to $11.8 billion. Sequentially, the segment’s top line decreased by 2.1% (+7.7% in MXN), primarily due to lower production volumes and decreased prices. Exploration and Production reported EBITDA rose 32.1% YoY but declined 13.5% sequentially to $6.9 billion in the quarter.

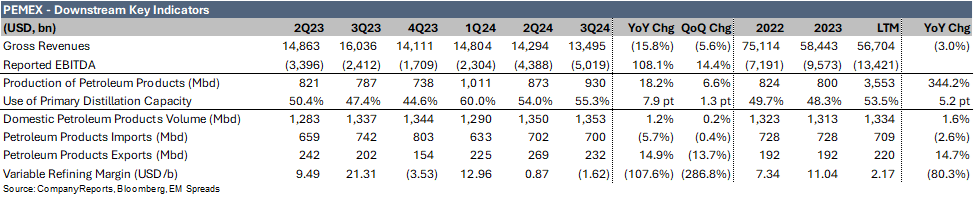

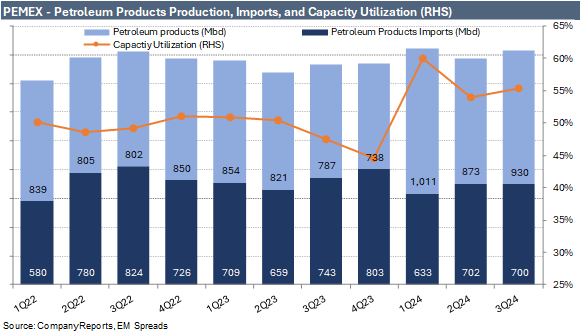

Downstream 3Q24 gross revenues totaled $13.5 billion, a decrease of 15.8% YoY (-6.6% in MXN). Sequentially, the segment’s top line declined by 5.6% (+3.8% in MXN), with refinery utilization reaching 55.3%, up 7.9 pp YoY and 1.3 pp QoQ. Industrial Transformation reported EBITDA was -$5.0 billion, a sharp decline from -$2.4 billion in 3Q23 and -$4.4 billion in 2Q24.

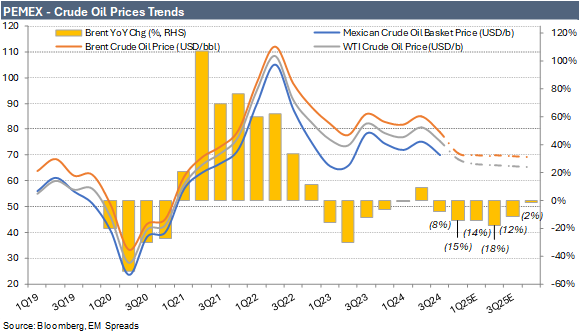

Unfavorable market conditions. In October 2024, Brent prices dropped by 14.8%, and the Mexican crude oil basket declined by 17.9%, reflecting the broader downward trend in oil markets. We expect lower year-over-year oil prices in the following quarters, up to and including 4Q25. This trend will likely further pressure PEMEX’s operating performance, credit profile, and liquidity.

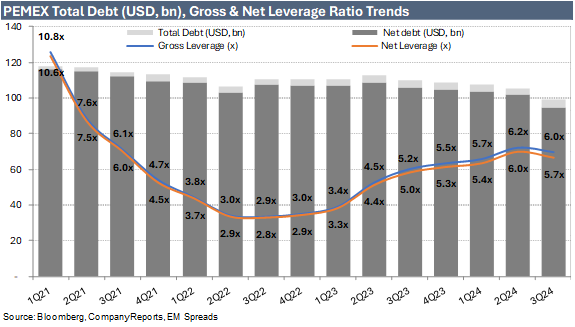

Unsustainable capital structure. PEMEX carries a significant debt burden, with total debt, including leases, amounting to $99.3 billion as of September 2024. The company’s gross leverage stands at 6.0x and net leverage at 5.7x, with negative FFO to debt and an interest coverage ratio of 1.9x. However, PEMEX has reduced its net debt by $11.3 billion since September 2023, a positive indicator for its credit profile.

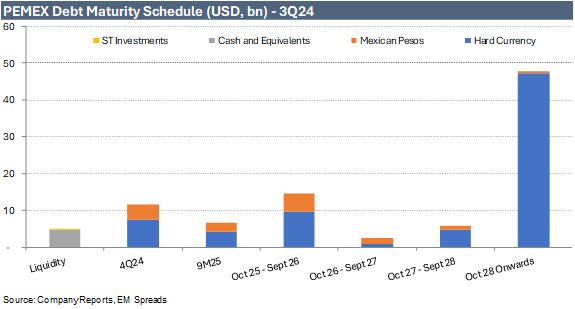

Weak liquidity. PEMEX’s liquidity remains a major concern, with $18.6 billion in short-term debt, including lease liabilities, representing nearly 400% of its cash position as of September 2024. Additionally, the limited availability of credit lines may indicate that some banks are becoming less willing to lend to the company.

Trade Recommendation

PEMEX, a state-owned entity, leads the Mexican oil and gas market and ranks among the largest oil companies in Latin America. Its credit story remains highly dependent on the strong likelihood of support from the Mexican government. The new administration has expressed its commitment to financial backing for PEMEX. However, actions carry more weight than rhetoric for state-owned companies in Latin America like PEMEX. Shortly after Claudia Sheinbaum assumed office, the Senate approved a bill to reclassify PEMEX as a public company. The bill now requires approval from state legislatures, where the ruling coalition holds a large majority. These developments indicate that the new administration views PEMEX as a strategically critical state asset rather than taking a more independent approach. Given PEMEX's unsustainable capital structure and unprofitable downstream operations, we see the reclassification as a positive step, supported by Mexico's significantly stronger credit profile.

Regarding 3Q24 results, PEMEX continued to demonstrate its vulnerability and significant reliance on government support. The sequential EBITDA recovery and debt reduction were encouraging, but substantial tax rebates and the absence of profit-sharing payments were crucial for the company's debt reduction. Nonetheless, gross and net leverage remained significantly high at 6.0x and 5.7x, respectively, and we continue to view PEMEX’s stand-alone capital structure as unsustainable. Furthermore, the company’s weak liquidity remains a major concern, with $18.6 billion in short-term debt, including lease liabilities, representing almost 400% of its cash position. Additionally, the limited availability of credit lines may suggest that certain banks are becoming less willing to lend to the company.

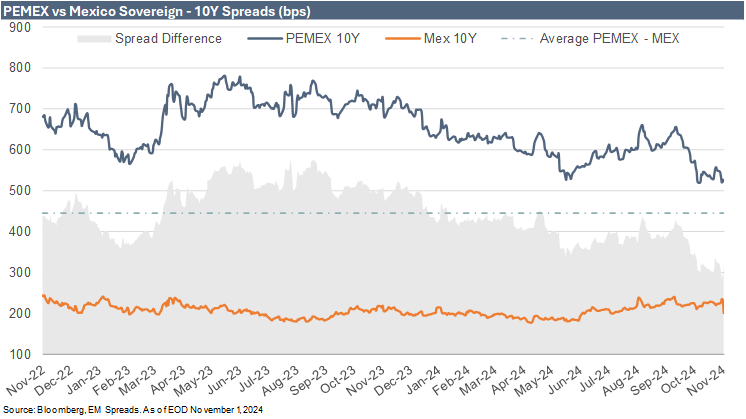

At around 320 bps, the current spread difference between PEMEX 10Y and Mexican Sovereign 10Y is 126 bps below the 2-year average of 446 bps, though still wider than the recent 2-year low of 283 bps reached on October 30, 2024. Year-to-date, the PEMEX 10Y and Mexico 10Y spread difference has ranged between 283 bps and 576 bps, placing current spreads closer to the tighter end of this range. In our view, this reflects a more accurate valuation of the significant support from the Mexican government. We believe that PEMEX’s reclassification, stronger linkage with the sovereign, and payment program to stabilize balances with suppliers and contractors could support further spread compression. For context, in early 2019, when PEMEX still held an investment-grade credit rating, the average spread difference between the company and the sovereign was 243 bps—significantly tighter than current levels. However, it’s worth noting that PEMEX’s overall credit profile was also stronger at that time, with better credit metrics.

At current spread levels, we find the following PEMEX bonds compelling due to their attractive yield pickup and the potential for a positive catalyst on the horizon: the PEMEX (B3/BBB/B+) 5.950% 2031, yielding 9.0% for a 5.0-year duration; the PEMEX 6.625% 2038, yielding 10.0% for a 7.9-year duration; and the PEMEX 7.690% 2050, yielding 10.3% for a 9.2-year duration. These bonds offer a favorable yield compared to sovereign bonds and are currently trading wider than the overall PEMEX curve. The spread pickup to the sovereign is more attractive at the belly and the long end than shorter-dated notes. Furthermore, most PEMEX bonds maturing before 2029 trade at or close to par, reducing any upside potential.

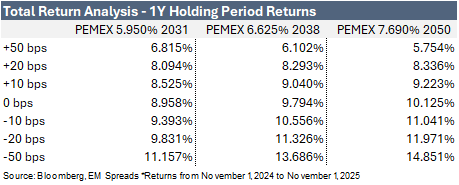

Total Return Analysis

3Q24 Operating Performance

In 3Q24, PEMEX’s revenues decreased significantly by 16.8% YoY (-7.7% in MXN) to $22.5 billion, down from $27.1 billion in 3Q23, with a sequential decline of 5.3% (+4.1% in MXN). The 10.9% YoY and 10.0% QoQ depreciation of the Mexican peso during the quarter substantially impacted PEMEX’s operating performance in US dollar terms. Domestic sales totaled $13.5 billion, a 9.4% (+0.5% in MXN) YoY decrease from $14.9 billion in 3Q23 and a 5.8% (+3.5%) decline QoQ. Mexican crude oil prices fell 9.7% YoY and 6.5% QoQ to $69.54/b in 3Q24, while domestic sales volumes of petroleum products rose by 1.2% YoY and 0.2% sequentially to 1,353 mbd. Export revenues declined significantly by 25.8% YoY and 4.5% sequentially to $9.0 billion in 3Q24, down from $12.2 billion in 3Q23 and $9.4 billion in 2Q24.

Gross profit stood at $2.4 billion in 3Q24, a notable decrease from $5.0 billion in 3Q23 and $3.1 billion in 2Q24. The gross margin contracted by 7.8 percentage points YoY and by 2.3 percentage points sequentially to 10.7%, as the cost of sales, including impairments, decreased by 8.8% YoY to $20.1 billion, declining more slowly than revenues.

Adjusted EBITDA for 3Q24 was $4.5 billion, an 8.6% YoY decrease from $4.9 billion but a substantial 38.8% sequential improvement from $3.2 billion. The adjusted EBITDA margin expanded by 1.8 percentage points YoY and by 6.3 percentage points QoQ to 20.0%. This sequential improvement was driven primarily by cost reductions, including a 12.6% QoQ decrease in SG&A and a 62.0% drop in other expenses. Additionally, a $1.8 billion impairment adjustment positively impacted adjusted EBITDA.

We remain cautious about PEMEX's outlook, given its pronounced sensitivity to fluctuations in global oil prices, which directly impact its revenue and profitability. Prolonged periods of low oil prices could significantly strain the company's cash flows, potentially hindering its ability to meet financial obligations, fund operations, or invest in essential exploration activities to maintain reserves.

In October 2024, Brent prices dropped by 14.8%, and the Mexican crude oil basket declined by 17.9%, reflecting the broader downward trend in oil markets. Market consensus suggests that year-over-year oil prices will continue to decline each quarter through 4Q25, underscoring the challenges ahead. With PEMEX already generating negative cash flow at an average crude oil basket price of $72.5/b in the first nine months of 2024, the ongoing downward trend in oil prices will likely intensify pressure on its cash flow generation. This trend could exacerbate liquidity constraints and limit the company's financial flexibility in the coming quarters.

On the macroeconomic front, Mexico’s GDP per capita is projected to grow modestly by 1.5% in 2024, 1.4% in 2025, and 2.0% in 2026. The fiscal deficit is expected to be significant at -5.2% in 2024, improving to -3.9% in 2025 and -3.4% in 2026. Nevertheless, the new president faces the challenge of balancing fiscal responsibility, environmental sustainability, and the political implications of reforming a state-owned enterprise that plays a significant role in Mexico's economy and politics. With Mexico’s budget deficit anticipated to exceed 5% of GDP and PEMEX’s stand-alone credit profile viewed as unsustainable, the government’s ability to continue providing financial support may come under pressure. However, Mexico's economy remains relatively resilient, supported by low unemployment and positive momentum from nearshoring trends that continue to attract foreign investment.

Strategy

PEMEX introduced its financial strategy under the new administration, emphasizing continued government support, close coordination with the Ministry of Finance and the Ministry of Energy, and a commitment to zero net indebtedness. The strategy, designed in conjunction with the Ministry of Finance, includes liability management initiatives and an ongoing focus on strengthening PEMEX’s ESG framework. Management confirmed that PEMEX is collaborating with the federal government to develop a financial strategy to bolster the company’s financial health. It has also confirmed its inclusion in the 2025 federal budget. Management indicated that a more comprehensive plan is needed to manage liabilities, which would help spread out maturities. Given the plan to avoid new market debt issuance, the debt burden is expected to fall primarily on the government.

The new administration appears highly supportive of PEMEX’s credit profile, and government coverage of debt maturities beyond 2025 would significantly enhance the company’s credit standing. Regarding the company’s obligations to suppliers, management highlighted the importance of suppliers and contractors to PEMEX. It noted ongoing efforts, in collaboration with the Ministries of Finance and Energy, to strengthen these relationships through a structured payment program, which we also view as credit-positive.

3Q24 Segment Results

Upstream – Exploration and Production

In 3Q24, Exploration and Production gross revenues declined by 9.5% YoY (+0.4% in MXN) to $11.8 billion from $13.1 billion in 3Q23, with a sequential decrease of 2.1% (+7.7%), primarily due to lower production volumes and decreased prices. Gross revenue per produced barrel fell by 4.4% YoY and 1.1% QoQ. The Mexican reference crude oil price averaged $69.54/b in 3Q24, down 9.7% from $76.98/b in 3Q23 and 6.5% lower than $74.38/b in 2Q24. By comparison, Brent crude oil prices declined by 8.4% YoY and 7.4% sequentially to $78.71/b. During the quarter, the Mexican crude oil basket experienced a larger discount, widening to $9.17/b from $8.94/b in 3Q23, although narrowing from $10.65/b in 2Q24. Meanwhile, Henry Hub prices were $2.23/MMBtu in 3Q24, marking a significant 16.2% YoY drop and a 3.8% sequential decline.

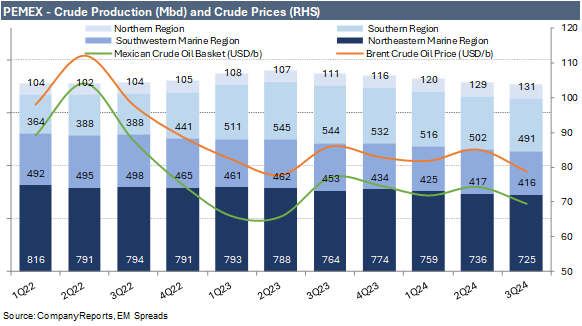

Production volumes declined in 3Q24, with PEMEX’s oil and condensate production averaging 1,746 Mbpd, excluding partners—a 5.6% decrease from 1,850 Mbpd in 3Q23 and down 1.1% from 1,766 Mbpd in 2Q24. Including partners, total production reached 1,776 Mbpd, reflecting a 5.4% YoY and 0.9% sequential decline, accounting for 71.0% of the total quarterly average hydrocarbons production. Production was constrained by declines in mature fields within the Northeastern Marine Region (Cantarell and Ku Maloob Zaap), which produced 725 Mbpd—a 5.0% YoY and 1.4% QoQ decrease. The Southwestern Marine Region recorded production of 416 Mbpd, down 8.1% YoY and 0.3% sequentially, while the Southern Region’s output stood at 491 Mbpd, marking a 9.7% YoY and 2.2% QoQ decline. The main factors contributing to lower production were natural declines in fields such as Maloob and Zaap, delays in marine infrastructure installation, adverse weather impacting offshore operations, and delays in completing complex wells due to depth, pressure, and temperature challenges. These declines were partially offset by growth in the Northern Region, which produced 131 Mbpd in 3Q24—an 18.8% YoY and 2.1% sequential increase. PEMEX has continued its strategy of developing smaller wells to offset the natural decline in mature fields. However, in 3Q24, PEMEX reported reduced drilling activity, with only six exploration wells drilled, down from 12 in 3Q23. Development wells also declined to 26 in 3Q24, compared to 44 in 3Q23 and 32 in 2Q24.

Natural gas production stood at 4,539 MMcfpd in 3Q24, down 8.3% from 4,950 MMcfpd in 3Q23, but relatively stable sequentially. This decline was primarily due to reductions in the Akal, Zaap, and Balam fields, as well as the shut-in of cyclical wells in the Northeast Marine region. Total hydrocarbon production reached 2,502 Mboed, representing a 6.0% YoY decline from 2,663 Mboed and a 0.6% sequential decrease. Consequently, the production pace for the first nine months of 2024 lags behind 2023, with an average of 2,531 Mboed in 9M24 compared to 2,688 Mboed during the same period in 2023.

Despite lower prices and volumes, E&P costs decreased by 30.4% YoY and 18.9% QoQ to $6.4 billion in 3Q24, down from $9.2 billion in 3Q23 and $7.9 billion in 2Q24. While the depreciation of the Mexican peso likely contributed to the reduction in costs, the extent of this impact is unclear. Consequently, Exploration and Production reported EBITDA increased significantly to $6.9 billion in 3Q24, up from $5.2 billion in 3Q23, although down sequentially from $7.9 billion.

Downstream – Industrial Transformation

In 3Q24, Industrial Transformation gross revenues totaled $13.5 billion, a decrease of 15.8% YoY (-6.6% in MXN) from $16.0 billion in 3Q23 and a sequential decline of 5.6% (+3.8% in MXN) from $14.3 billion in 2Q24. Refinery utilization stood at 55.3%, up 7.9 percentage points from 47.4% in 3Q23 and 1.3 percentage points from 54.0% in 2Q24, resulting in petroleum product production volumes of 930 Mbd, an increase of 18.2% YoY and 6.6% sequentially. During the quarter, PEMEX’s domestic sales volumes of petroleum products remained relatively stable, rising by 1.2% YoY and 0.2% QoQ to 1,353 Mbd. With higher production levels, petroleum product imports decreased by 5.7% YoY and 0.4% sequentially to 700 Mbd, accounting for 51.7% of domestic sales. Export volumes of petroleum products rose 14.9% YoY to 232 Mbd but declined 13.7% sequentially.

The variable refining margin turned negative to -$1.62/b in 3Q24, a significant deterioration from $0.87/b in 2Q24 and $21.31/b in 3Q23, primarily due to lower refined product prices in the Gulf Coast reference market. Consequently, Industrial Transformation reported EBITDA was -$5.0 billion in 3Q24, a sharp decline from -$2.4 billion in 3Q23 and -$4.4 billion in 2Q24.

Financial Profile

PEMEX ended 3Q24 with $99.3 billion in total debt, including $2.3 billion in lease obligations, marking a reduction of $6.2 billion from $105.5 billion as of June 2024 (December 2023: $108.9 billion). Gross debt reached a new low for the quarter, showing a $10.3 billion decrease compared to 3Q23. As of September 2024, cash and cash equivalents stood at $4.7 billion, up from $3.7 billion in June 2024 and $4.1 billion in December 2023. Consequently, net debt declined by $7.3 billion to $94.6 billion as of September 2024, down from $101.9 billion in June 2024 (December 2023: $104.8 billion). Overall, PEMEX has reduced its net debt by $11.3 billion since September 2023, a positive indicator of its credit profile.

Adjusted EBITDA of $4.5 billion was insufficient to cover $3.1 billion in capex and $2.3 billion in interest expense, resulting in a free cash outflow of -$832.7 million. Capex was 24.0% lower YoY and 49.7% lower sequentially, down from $4.1 billion in 3Q23 and $6.1 billion in 2Q24. According to our calculations, PEMEX spent $12.5 billion on capex in the first nine months of 2024 (9M23: $11.9 billion). In contrast, interest expense increased by 5.2% YoY and 4.7% QoQ. As a result, free cash flow improved from -$1.3 billion in 3Q23 and -$5.0 billion in 2Q24. Funds from operations (adjusted EBITDA minus interest expenses and income taxes) turned positive to $2.6 billion, significantly up from -$2.3 billion in 2Q24 and $1.3 billion in 3Q23. Adjusted EBITDA covered $2.3 billion in interest expense, and taxes were reported as an inflow of $318.7 million, which provided a notable boost to PEMEX's cash generation compared to outflows of $3.4 billion in 2Q24 and $1.5 billion in 3Q23.

Government contributions were relatively low at $291.0 million in 3Q24, compared to $3.9 billion in 2Q24 and $5.0 billion in 3Q23. However, PEMEX did not pay any profit-sharing duty this quarter, compared to $1.8 billion in 2Q24 and $3.1 billion in 3Q23. The company also benefited from a $2.5 billion credit under other taxes and duties, compared to -$472.7 million in 2Q24 and $1.6 billion in 3Q23.

As a result, key credit metrics benefited from a lower debt balance but were pressured by higher interest and decreased EBITDA:

Gross leverage decreased to 6.0x as of September 2024 from 6.2x as of June 2024 (December 2023: 5.5x).

Net leverage declined to 5.7x as of September 2024 from 6.0x as of June 2024 (December 2023: 5.3x).

Cash interest coverage was 1.9x as of September 2024, modestly down from 2.0x as of June 2024 (December 2023: 2.3x).

FFO to gross debt improved to -0.2% as of September 2024 from -1.4% as of June 2024 (December 2023: -0.9%).

Liquidity

We assess PEMEX’s liquidity as weak. As of September 2024, the company had $18.6 billion in short-term debt, representing 18.8% of total debt and close to 400% of its cash position. With cash and cash equivalents totaling $4.7 billion and only $80 million available in revolving credit facilities, PEMEX's liquidity covers merely 25.8% of its short-term debt obligations. The company's revolving credit facilities have a total capacity of $6.9 billion, comprising $5.9 billion and P$20.5 billion (approximately $1.0 billion). However, the minimal available borrowing capacity suggests a potential reluctance from financial institutions to extend further credit, which remains a significant liquidity concern. Although PEMEX’s debt amortization profile is spread out, the company faces substantial short-term debt maturities.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.