Pemex: Lack of Concrete Action Weights on the Outperform Thesis

We need to see concrete action from the Mexican government to maintain an Outperform recommendation.

Downgrading Pemex to Market Perform

Since before Claudia Sheinbaum’s election, both the previous and current administrations have emphasized that government financial support for Pemex is in the country’s best interest, positioning the company as a strategic asset for Mexico’s economy. The new administration has continued efforts to reclassify Pemex as a public entity rather than a productive enterprise, incorporating it into the 2025 government budget with a promised ~US$6.7 billion in support. Additionally, the administration has made some positive statements in recent weeks, including assurances that Pemex will not tap the debt market in 2025. President Sheinbaum also announced in a press briefing that Pemex's outstanding payments to suppliers are expected to be settled by March 2025, while the administration has signaled openness to joint ventures in the exploration and production sector. On January 29, 2025, Sheinbaum further proposed an energy reform aimed at reinforcing state control over the sector.

We see these comments as positive for a credit story that remains highly dependent on financial support from the Mexican government, given Pemex’s unsustainable standalone credit profile, which is characterized by a significant debt burden, weak liquidity, high debt service costs, and persistent negative cash flows. However, since the administration took office in October 2024, we have yet to see sufficient action, which we believe weighs negatively on Pemex’s credit outlook.

The ongoing payment delays to suppliers and contractors, with outstanding debts amounting to P$402.9 billion (US$19.6 billion) as of September 2024, remain highly concerning. Thus far, the only response has been partial payments made in December 2024, covering just 3–5% of the total debt, leaving many businesses, particularly in key oil-producing regions like Tabasco and Campeche, struggling with liquidity issues. These prolonged delays have led to widespread economic repercussions, including layoffs, operational disruptions, and heightened unemployment among subcontractors. Protests have erupted in Tabasco, with suppliers criticizing Pemex for failing to meet prior payment commitments.

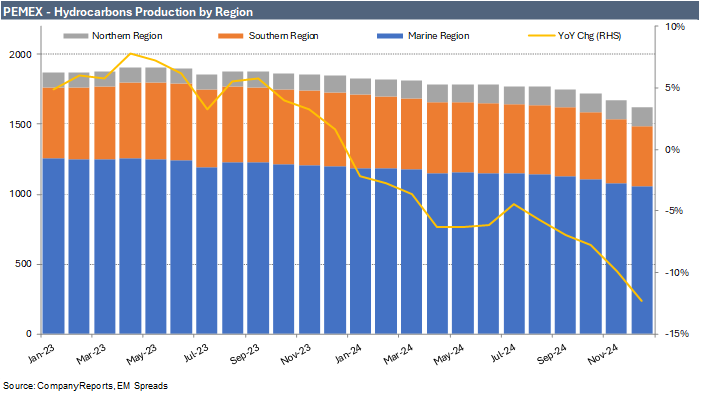

In her inauguration speech to Congress, Sheinbaum also stated that Pemex would stabilize production at around 1.8 million barrels per day (mboed). However, production, including contributions from partners, has declined, reaching 1.718 mboed in October, 1.673 mboed in November, and 1.619 mboed in December 2024, representing YoY declines of 7.8%, 9.9%, and 12.3%, respectively.

Moreover, the slower-than-expected ramp-up of the Dos Bocas refinery suggests that any operational improvements may take longer than anticipated. Designed to process 340,000 barrels per day of heavy sour Maya crude, the refinery has faced persistent challenges since its inauguration in July 2022. Issues related to crude quality, electricity, and financial constraints have caused repeated delays in reaching full operational capacity. While intended to be a cornerstone of Mexico’s strategy to achieve energy independence, Dos Bocas has struggled to perform as expected.

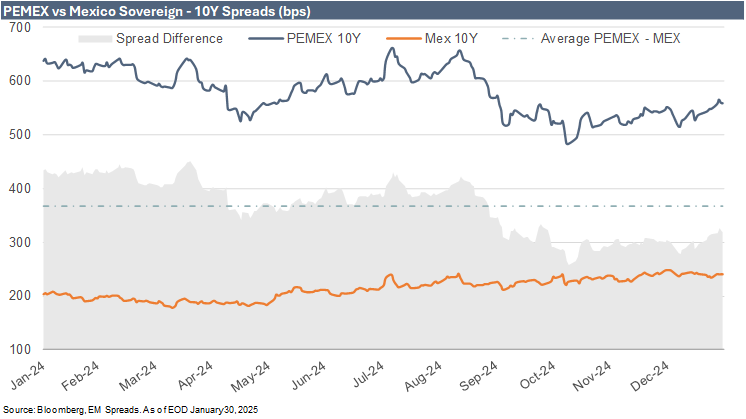

At around 319 bps, the current spread difference between PEMEX 10Y and Mexican Sovereign 10Y is 48 bps below the one-year average of 367 bps, though still wider than the one-year low of 258 bps reached on November 8, 2024. Year-to-date, the PEMEX 10Y–Mexico 10Y spread difference has ranged between 278 bps and 326 bps, placing current spreads near the wider end of this range. Over the past twelve months, the spread difference has ranged between 258 bps and 450 bps, currently sitting closer to the tighter end of this range. However, spreads remain 31 bps tighter than when we initiated coverage with an Outperform recommendation on September 29, 2024. For context, in early 2019, when Pemex still held an investment-grade credit rating, the average spread difference between the company and the sovereign was 243 bps, significantly tighter than current levels. However, Pemex’s overall credit profile was also stronger at that time, with significantly better credit metrics.

At this point, we need to see concrete action from the Mexican government to maintain an Outperform recommendation. As a result, we are downgrading Pemex to Market Perform. In our view, current spreads accurately reflect the level of government support, but further spread compression will require tangible actions. Meanwhile, Pemex’s deteriorating operational metrics will likely increase its need for government assistance.

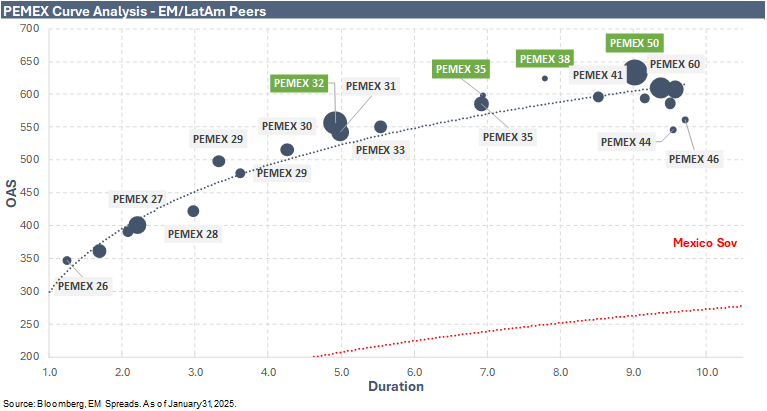

Within Pemex’s capital structure, we continue to prefer the PEMEX (B3/BBB/B+) 5.950% 2031, yielding 9.0% for a 5.0-year duration; the PEMEX 6.625% 2035, yielding 9.8% for a 6.9-year duration; the PEMEX 6.625% 2038, yielding 10.1% for a 7.8-year duration; and the PEMEX 7.690% 2050, yielding 10.4% for a 9.0-year duration. These bonds offer an attractive yield pickup relative to sovereign bonds and are currently trading wider than the overall Pemex curve. The spread pickup to the sovereign is more favorable at the belly and long end of the curve than in shorter-dated notes. Furthermore, most Pemex bonds maturing before 2029 trade at or near par, reducing their upside potential, while the 2031s, 2038s, and 2050s trade well below par at $84.0, $72.7, and $74.6, respectively.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.