Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

Tight Supply, Strong Cash Flow, and Deleveraging Support Suzano’s Credit Profile

Executive Summary

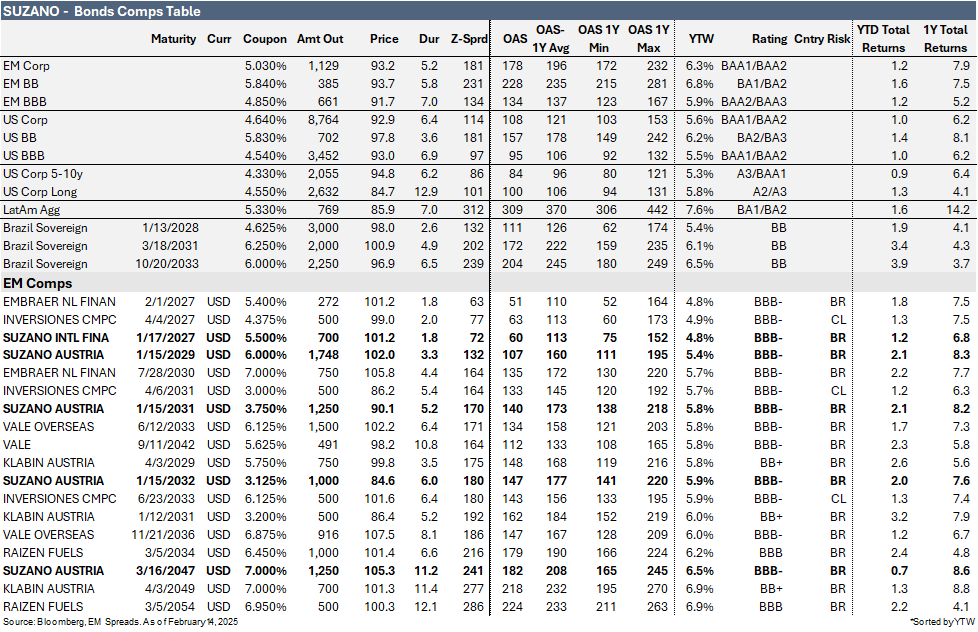

We upgraded Suzano’s 2031s and 2032s to Outperform, while maintaining the rest of the curve at Market Perform. Despite additional industry supply, tight market conditions persist due to low stock levels, maintenance-related production cuts, and operational disruptions. Healthy pulp prices, higher sales volumes, controlled costs, and a focus on deleveraging should support Suzano’s cash generation and credit profile in 2025, with this trend likely continuing as no major new supply is expected. Management downplayed U.S. tariff risks, noting that tariffs have applied only to paper, not pulp, and that U.S. hardwood shortages and a lack of domestic pulp investment reduce the likelihood of future tariffs. Suzano’s export focus also mitigates concerns over Brazil’s economic outlook.

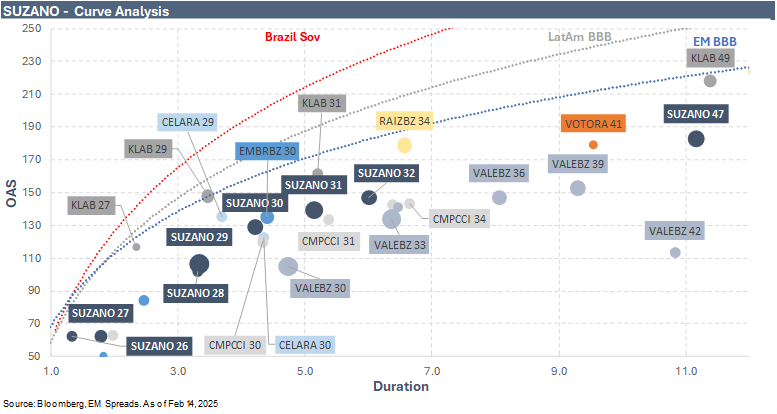

Within Suzano’s capital structure, we prefer the 3.750% 2031 and 3.125% 2032 bonds, which compare favorably to select regional peers, the broader EM BBB Index, and the US BBB Index. Additionally, these notes trade below par at $90.1 and $84.6, respectively, while most of Suzano’s curve remains priced above par.

Suzano posted strong 4Q24 results. Supported by the Pulp segment outperforming despite pricing headwinds. EBITDA reached R$6.5 billion, down a modest 0.6% QoQ but 5.3% above expectations, driven by a 24.6% QoQ increase in pulp volumes, a 6.5% decline in cash costs per ton (excluding downtime), and better-than-expected pricing despite an 8.4% drop in BRL terms. Pulp EBITDA rose 0.6% QoQ to R$5.7 billion, while paper EBITDA fell 9.0% QoQ to R$751 million due to higher costs from the new U.S. packaging operations.

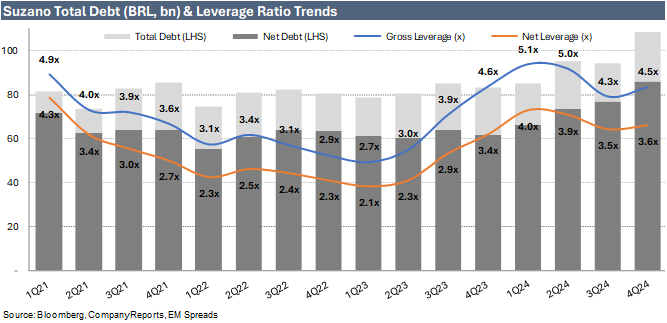

From a credit perspective. Suzano's results showed improved LTM EBITDA and positive net free cash flow, but net leverage rose slightly to 3.3x due to FX-driven debt increases. The company remains committed to deleveraging, maintaining a 2-3x net leverage target, and does not plan major acquisitions that could hinder progress. Instead, Suzano is expected to focus on smaller, strategic acquisitions in the U.S. paper and packaging market.

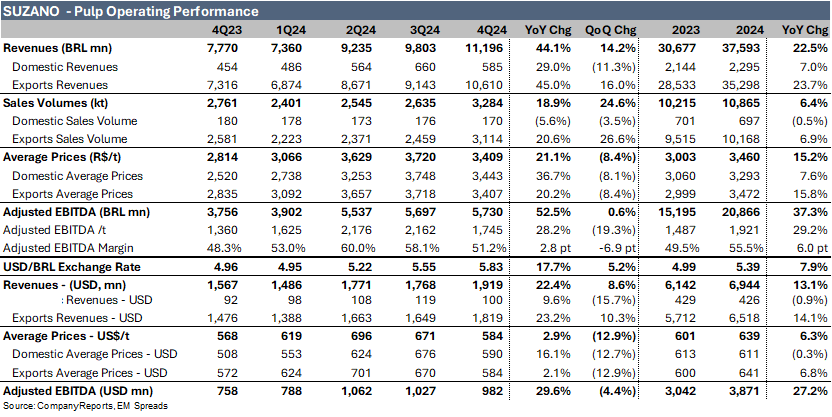

Pulp Segment. Suzano’s pulp revenues rose 14.2% QoQ and 44.1% YoY to R$11.2 billion in 4Q24, driven by a 24.6% QoQ and 18.9% YoY increase in sales volumes to 3,284 kilotons, particularly in Asia and North America, and the stabilization of production at the Ribas unit. A 5.2% BRL depreciation also supported growth, though this was partially offset by an 8.4% QoQ decline in BRL pulp prices. Pulp adjusted EBITDA increased 0.6% QoQ and 52.5% YoY to R$5.7 billion, though the EBITDA margin contracted sequentially to 51.2% from 58.1% in 3Q24. Pulp EBITDA per ton fell 19.3% QoQ to R$1,745 per ton but remained above 4Q23 levels.

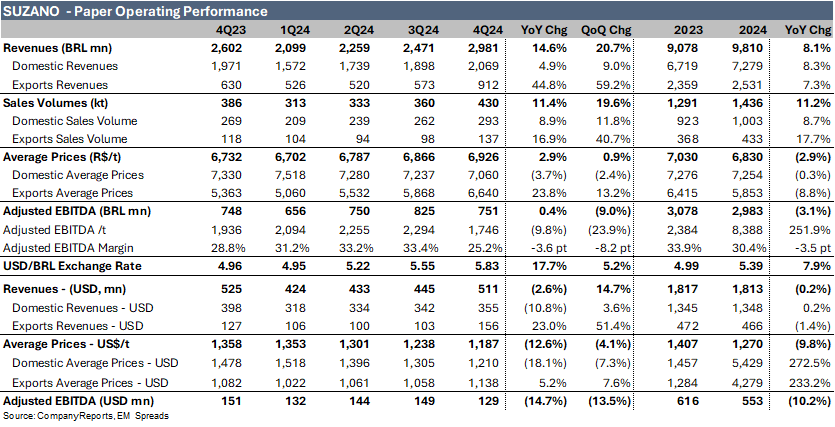

Paper Segment. Suzano’s paper revenues rose 20.7% QoQ and 14.6% YoY to R$3.0 billion in 4Q24, driven by a 19.6% increase in sales volumes to 430 kt, supported by higher volumes from Suzano Packaging U.S., and a slight uptick in BRL prices. However, paper adjusted EBITDA declined 9.0% QoQ to R$751 million, with the margin contracting to 25.2% from 33.4% in 3Q24 due to higher COGS and increased SG&A expenses related to the U.S. operations. Despite lower input and wood costs, EBITDA per ton fell 23.9% QoQ and 9.8% YoY to R$1,746 per ton.

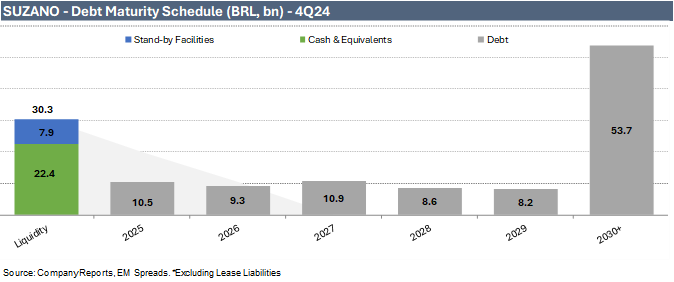

We view Suzano’s liquidity as strong. As of December 2024, the company held R$22.4 billion in cash and equivalents and had R$7.9 billion (US$1.3 billion) in available standby facilities maturing in February 2027, bringing total liquidity to R$30.3 billion. This is sufficient to cover debt obligations through 2026 and most of 2027. Short-term debt stood at R$10.5 billion, representing 46.9% of cash and 9.7% of total debt.

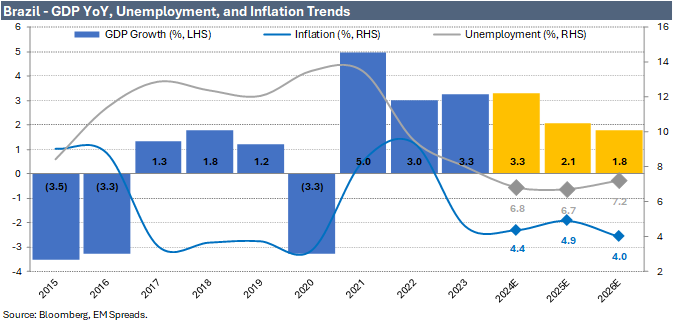

Brazil macro. After two years of +3% GDP growth, Brazil’s economy is set to moderate, with GDP projected at 2.1% in 2025 and 1.8% in 2026 as tight monetary policy and potential fiscal constraints take effect. Inflation is expected to close 2024 at 4.4%, above target, with a 4.9% forecast for 2025 reflecting anticipated rate hikes and fiscal tightening before easing to 4.0% in 2026. Unemployment is projected to decline to 6.8% in 2024 but could rise to 7.2% in 2026 amid tighter policy.

Trade Recommendation

Suzano delivered solid 4Q24 results, with the pulp segment as the standout. Despite a challenging pricing environment, the company generated strong EBITDA of R$6.5 billion in the quarter, reflecting a modest 0.6% QoQ contraction but exceeding expectations by 5.3%. This performance was primarily driven by higher pulp volumes, up 24.6% QoQ, lower costs as cash cost per ton declined 6.5% QoQ (excluding downtime), and lower but better-than-expected prices, down 8.4% in BRL terms. These factors contributed to Pulp EBITDA of R$5.7 billion, a 0.6% QoQ increase. In contrast, paper EBITDA declined 9.0% QoQ to R$751 million, mainly due to higher costs associated with the new U.S. packaging operations.

From a credit perspective, the results were marked by improved LTM EBITDA and positive net free cash flow, though these were offset by an increase in Suzano’s outstanding debt, mainly due to FX variation. As a result, net leverage rose slightly by 0.1x to 3.3x. However, Suzano has reiterated its commitment to deleveraging, targeting net leverage of 2-3x, and does not plan to pursue large acquisitions in the near term that could slow progress. Instead, the company is expected to focus on smaller, strategic acquisitions in the U.S. paper and packaging market.

Despite the significant additional supply the industry is absorbing, supply conditions are expected to remain tight given low stock levels and reduced production from maintenance shutdowns. Other contributing factors include the shift of hardwood volumes to dissolving pulp, labor strikes, and operational disruptions. As a result, we expect the combination of healthier-than-anticipated pulp prices, higher sales volumes from the Ribas unit, normalized capital expenditures, manageable costs, and a clear commitment to deleveraging to drive positive cash generation and strengthen Suzano’s credit profile in 2025. This trend is likely to persist in the coming years, as no significant additional supply is projected to come online.

Suzano’s management provided some context on U.S. tariffs, noting that in recent years, tariffs have applied only to the paper market and not to pulp. Additionally, the U.S. is currently short of hardwood, and management does not expect incentive plans to develop pulp plants in the country, further reducing the possibility of U.S. tariffs on pulp. Regarding concerns about the Brazilian economy and the potential impact of U.S. tariffs, we see this as less of a risk for Suzano, given its strong reliance on exports.

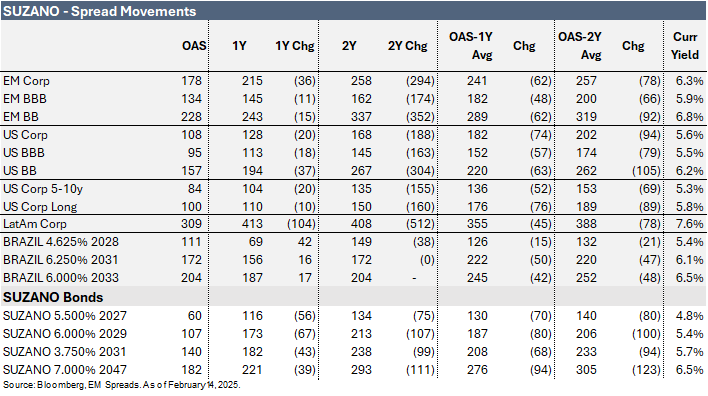

Suzano (Baa3/BBB-/BBB-) bonds have tightened over the past year. The 6.000% 2029 notes contracted by 67 bps to 107 bps, the 3.750% 2031 notes tightened by 43 bps to 140 bps, and the 7.000% 2047 notes narrowed by 39 bps to 182 bps. Currently, spreads for the 2029s, 2031s, and 2047s are trading 80 bps, 68 bps, and 94 bps, respectively, below their one-year OAS average and 100 bps, 94 bps, and 123 bps tighter than their two-year average.

Over the same period, the broader Emerging Markets Index contracted by 36 bps to 178 bps, the US Index tightened by 20 bps to 108 bps, and the Latin America Aggregate Index declined by 104 bps to 309 bps.

Suzano’s spread tightening is particularly notable given that some comparable Brazilian sovereign bonds saw spreads widen during the same period. Brazilian sovereign bonds maturing in 2028 are trading at 111 bps, 42 bps wider than a year ago, and 15 bps tighter than their one-year average. Bonds maturing in 2033 are trading at 204 bps, 17 bps above a year ago and in line with their one-year average.

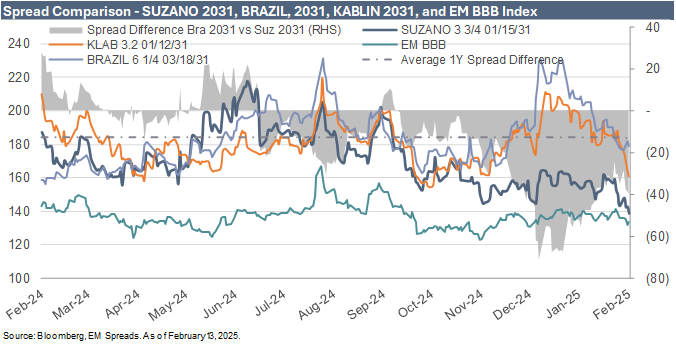

The spread difference between the Brazilian 6.250% 2031 notes (4.9-year duration) and the Suzano 3.750% 2031 notes (5.2-year duration) currently stands at -33 bps, 20 bps below the one-year average of -13 bps. This reflects Suzano’s notes trading at 140 bps while the Brazilian sovereign notes are at 172 bps. Over the past twelve months, this spread difference has ranged from 28 bps to -71 bps, with current levels below the midpoint of this range and closer to the tighter end.

Similarly, the spread difference between the Klabin 3.200% 2031 notes (5.3-year duration) and the Suzano 3.750% 2031 notes is currently -22 bps, 13 bps below the one-year average of -9 bps, with Klabin’s notes trading at 162 bps. Comparing Suzano’s 2031 notes to the broader Emerging Market BBB Index (7.0-year duration), the spread difference stands at 5 bps, down from the one-year average of 34 bps, with the index trading at 134 bps.

Considering these factors and current spread levels, we are upgrading Suzano’s recommendation to Outperform for the Suzano 3.750% 2031 bonds, yielding 5.7% for a 5.2-year duration, and the Suzano 3.125% 2032 bonds, yielding 5.9% for a 6.0-year duration, while maintaining a Market Perform rating for the rest of the curve.

For comparison, the broader EM BBB Index yields 5.9% for a 7.0-year average duration, while the U.S. BBB Index yields 5.5% for a 6.9-year average duration. Current yields also compare favorably to some regional peers, including VALEBZ (Baa2/BBB-/BBB) 6.125% 2033 notes yielding 5.8% for a 6.4-year duration, CMPCCI (Baa3/BBB/BBB) 3.000% 2031 notes yielding 5.7% for a 5.4-year duration, and EMBRBZ (BBB-/BBB-) 7.000% 2030 notes yielding 5.7% for a 4.4-year duration.

Additionally, Suzano’s 2031 and 2032 bonds trade well below par at $90.1 and $84.6, respectively, while most of the rest of Suzano’s curve is priced above par.

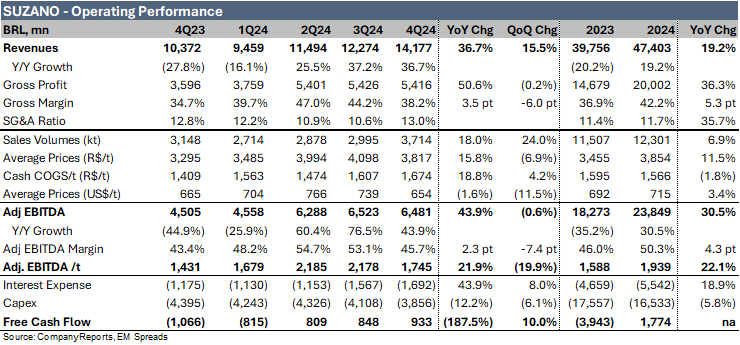

4Q24 Operating Performance

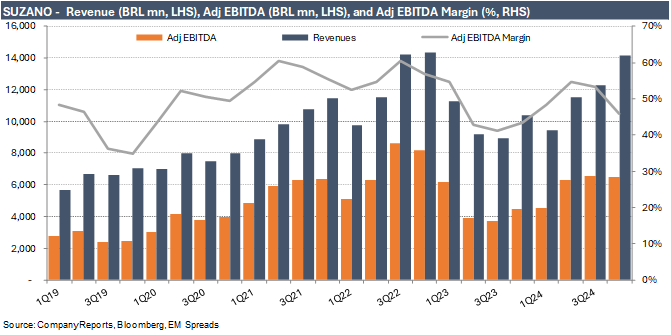

In the fourth quarter of 2024, Suzano’s revenue increased by 15.5% QoQ and 36.7% YoY to R$14.2 billion, compared to R$12.3 billion in 3Q24 and R$10.4 billion in 4Q23, exceeding market expectations by 12.4%. Exports accounted for 81% of revenue, up from 79% in the previous quarter and 77% in the same period last year. The sequential top-line improvement was primarily driven by a 24.0% increase in sales volumes to 3,714 kilotons from 2,995 kilotons in 3Q24, as well as the impact of the 5.2% appreciation of the U.S. dollar against the Brazilian real. These factors were partially offset by a 6.9% decline in USD prices.

Gross profit decreased modestly by 0.2% QoQ to R$5.4 billion but was significantly higher than R$3.6 billion in 4Q23. The gross margin contracted by 6.0 percentage points to 38.2% from 44.2% in 3Q24, though it improved compared to 34.7% in the same period last year. The margin contraction was primarily due to a 27.9% sequential increase in the cost of goods sold to R$8.8 billion in 4Q24 from R$6.8 billion in 3Q24, reflecting higher pulp sales volumes, primarily provided by the new Ribas mill, additional cost impact due to the new operation of Suzano Packaging in the U.S., currency depreciation on items exposed to foreign currency, the effect of higher scheduled maintenance downtime, and increased logistical costs related to the mill mix effect. Consequently, cash COGS per ton rose 4.2% QoQ to R$1.7 billion/t.

Adjusted EBITDA was R$6.5 billion in 4Q24, representing a QoQ decline of 0.6% but a YoY improvement of 43.9%, surpassing expectations by 5.3%. The adjusted EBITDA margin contracted by 7.4 percentage points sequentially to 45.7% in 4Q24 from 53.1% in 3Q24 but expanded YoY from 43.4% in 4Q23. Adjusted EBITDA per ton declined by 19.9% to R$1,745/t in 4Q24 from R$2,178/t in 3Q24 and R$2,185/t in 2Q24 (4Q23: R$1,431/t).

Outlook & Management’s Comments

Downtime. Suzano is expected to face an intensive 1Q25 of scheduled maintenance downtime, with five mills, representing 51% of its capacity, undergoing maintenance. This includes Aracruz (920 kt capacity), Mecuri (600 kt), Ribas (2,550 kt), Três Lagoas 1 (1,300 kt), and Três Lagoas 2 (1,950 kt).

Capex. Management approved a capital budget of R$12.4 billion for 2025, a significant reduction from R$17.1 billion in 2024 and R$18.6 billion in 2023. Of this, R$7.8 billion is allocated to industrial and forestry maintenance. The decrease is partly driven by the completion of the learning curve at the Ribas unit, which already has the lowest cash cost among Suzano’s mills. After scheduled downtime in 1Q25, the unit is expected to resume operations with even more competitive cash costs. The Ribas unit has only R$0.9 billion in remaining capex for 2025.

Deleveraging. Suzano has reaffirmed its commitment to deleveraging by avoiding large acquisitions that could slow progress. Instead, the company is expected to focus on smaller, strategic acquisitions in the U.S. paper and packaging market. Management also noted that its share buyback program remains an option but will be executed only under the right circumstances, balancing it within the broader capital allocation strategy.

Costs. Suzano expects cash costs, excluding downtime, to rise by a mid-single-digit percentage in 1Q25 but to remain flat for the full year. The concentration of maintenance downtime at its largest and most competitive mills, such as Três Lagoas and Ribas, is the primary driver of the expected short-term increase. However, the 2025 flat cash cost outlook represents a modest increase from previous guidance, which management attributed mainly to foreign exchange impacts. Suzano’s costs are 23% linked to the U.S. dollar, meaning that every $0.10 depreciation in the exchange rate adds approximately R$4 per ton to cash costs.

Supply and Demand. Management highlighted ongoing supply constraints due to elevated maintenance downtime and strong market demand. The recent shutdown of a competitor’s operations has further disrupted the market, tightening inventories and driving higher-than-expected demand. Supply conditions are expected to remain tight given low stock levels and reduced production from maintenance shutdowns. Additional factors contributing to the imbalance include the shift of hardwood volumes to dissolving pulp, labor strikes, and operational disruptions. The shutdown of Chenming has also had an indirect impact, with Suzano estimating that each month of lost supply adds approximately 200 kt of new hardwood demand. As a result, the company foresees challenges in meeting demand. Moreover, management noted that the widening spread between softwood and hardwood has contributed to a more favorable pricing environment.

Brazil Macro

After two consecutive years of GDP growth above 3%, Brazil’s economic expansion is expected to moderate as tight monetary policy and a potential slowdown in public spending take effect. GDP growth is projected at 2.1% in 2025 and 1.8% in 2026. Inflation is expected to close at 4.4% in 2024, exceeding the 3% target band ceiling. Managing inflation in 2025 will likely require a coordinated policy effort, with the 4.9% inflation forecast reflecting anticipated rate hikes and a smaller budget deficit. Inflation is expected to ease to 4.0% in 2026. Brazil’s unemployment rate is projected to decline to 6.8% in 2024, continuing the labor market improvements seen since 2021. However, ongoing monetary and fiscal tightening is expected to weigh on employment in the coming quarters, keeping unemployment relatively stable in 2025 before rising to 7.2% in 2026.

In 2024, the Brazilian real weakened to its lowest nominal level, while the fiscal deficit remained elevated at 8.8% of GDP. Although the currency is expected to stabilize in 2025, the fiscal deficit is projected to narrow only modestly to 8.5% in 2025 and 8.0% in 2026. On trade policy, Brazil maintains a trade deficit with the United States, making it unlikely to be a primary focus of the Trump administration. However, if U.S. tariffs were to exert pressure on Brazil, its export sector, which is one of the country’s key economic drivers, could be negatively affected. This could potentially constrain economic growth.

4Q24 Pulp Segment’s Operating Performance

The fourth quarter of 2024 saw a slowdown in hardwood pulp price declines and increased pulp availability. In China, prices for paperboard, printing, and writing paper initially fell but rebounded following the temporary exit of a producer, with production volumes declining 9% and 7% QoQ, respectively. The tissue segment remained strong, with production increasing by 2% and inventories decreasing by 3%. In Europe, hardwood pulp consumption rose 4% QoQ, while softwood pulp consumption grew by just 1%, reflecting fiber substitution due to the widening price spread. North America's sanitary paper market showed healthy pulp demand amid improving economic conditions.

Hardwood pulp supply expanded with the ramp-up of production at Ribas do Rio Pardo in Brazil and Liansheng in China, despite a reduction in unplanned downtime. Conversely, unplanned mill shutdowns in Finland and widening price spreads further encouraged softwood-to-hardwood substitution. Hardwood pulp prices fell 14% QoQ in China and 20% in Europe, with the softwood-hardwood price gap reaching $216 per ton in China and $425 per ton in Europe. Suzano’s pulp sales increased 25% QoQ and 19% YoY to 3.28 million tons, driven by higher volumes in Asia and North America.

In 4Q24, Suzano’s pulp revenues, which accounted for 79% of total 2024 revenues, rose 14.2% QoQ and 44.1% YoY to R$11.2 billion, up from R$9.8 billion in 3Q24 and R$7.8 billion in 4Q23. This growth was primarily driven by a significant increase in sales volumes, up 24.6% QoQ and 18.9% YoY to 3,284 kilotons, supported by higher volumes in Asia and North America and the stabilization of production at the Ribas unit. The top line also benefited from a 5.2% sequential depreciation of the Brazilian real, partially offset by an 8.4% QoQ decline in BRL average prices to R$3,409 per ton in 4Q24 from R$3,720 per ton in 3Q24 (4Q23: R$2,814 per ton).

In USD terms, pulp revenues increased 8.6% QoQ to $1.9 billion, primarily due to higher sales volumes. However, lower average USD prices of $584 per ton in the quarter, compared to $671 per ton in 3Q24 (4Q23: $568 per ton), partially offset this.

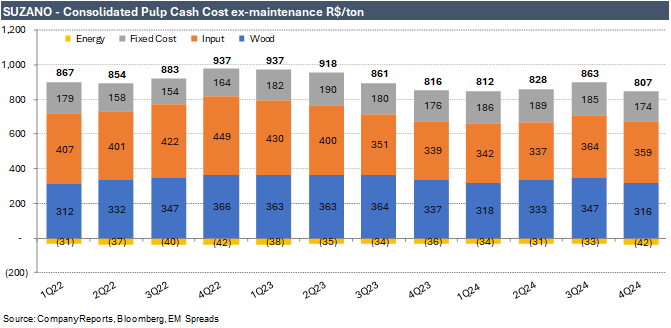

Cash costs, excluding downtime, were R$807 per ton in 4Q24, down 6.5% QoQ and 1.1% YoY from R$863 per ton in 3Q24 and R$816 per ton in 4Q23. The sequential decrease was primarily driven by (1) lower wood costs due to a reduction in the average radius, (2) lower input consumption, mainly energy, attributed to improved operational stability at certain mills and lower energy product prices, (3) more significant fixed-cost dilution due to higher pulp production volume at the Ribas unit, and (4) higher utilities revenues, as the Ribas unit generated more energy for export. These factors were partially offset by the 5.2% sequential depreciation of the Brazilian real, which increased USD-denominated costs. We note that total cash costs, including downtime, decreased 5.6% sequentially to R$880 per ton, with R$25 per ton related to the Ribas start-up in 3Q24. However, total cash costs increased 7.8% YoY.

In 4Q24, pulp adjusted EBITDA was R$5.7 billion, marking a 0.6% QoQ increase and a significant 52.5% YoY improvement from R$3.8 billion in 4Q23. However, the adjusted EBITDA margin contracted sequentially to 51.2% in 4Q24 from 58.1% in 3Q24 but remained higher than 48.3% in 4Q23. Pulp adjusted EBITDA per ton declined 19.3% QoQ to R$1,745 per ton in 4Q24 from R$2,162 per ton in 3Q24 (4Q23: R$1,360 per ton). In USD terms, adjusted EBITDA decreased 4.4% QoQ to $982 million in 4Q24 from $1.0 billion in 3Q24 (4Q23: $758 million).

4Q24 Paper Segment’s Operating Performance

In Brazil, demand for printing and writing paper increased 7% QoQ and 12% YoY in the first two months of 4Q24, supported by improved economic activity and higher government textbook purchases. Demand for coated papers declined QoQ following the end of the electoral cycle, though this was offset by growth in uncoated paper. Internationally, demand remained strong in North and Latin America due to local factors, while Europe showed signs of returning to a structural decline. Paperboard demand in Brazil fell 4% QoQ but grew 9.5% YoY, reflecting household consumption growth but also a late-year economic slowdown in some sectors. Suzano’s accessible paper market demand grew 11% YoY in early 4Q24, with full-year demand increasing 5% YoY. The quarter also marked the completion of its Pactiv Evergreen acquisition in the U.S., with integration progressing as planned. Suzano renegotiated commercial contracts under more favorable terms and is executing an industrial turnaround to improve operations and increase production.

In 4Q24, Suzano’s paper revenues, which accounted for 21% of total 2024 revenues, reached R$3.0 billion, rising 20.7% QoQ and 14.6% YoY from R$2.5 billion in 3Q24 and R$2.6 billion in 4Q23. The sequential improvement was primarily driven by a 19.6% increase in sales volumes to 430 kt, supported by higher volumes from Suzano Packaging U.S., along with a 0.9% sequential increase in average prices in Brazilian reals to R$6,926 per ton.

Suzano’s domestic paper sales volumes, including printing and writing, paperboard, and tissue, reached 293 kt in 4Q24, up 11.8% QoQ and 8.9% YoY, with the sequential improvement primarily driven by growth in uncoated paper sales. International paper sales volumes totaled 137 kt, increasing significantly by 40.7% QoQ, mainly due to the addition of new volumes from Suzano Packaging U.S. starting in October 2024.

Paper adjusted EBITDA was R$751 million in 4Q24, down 9.0% QoQ from R$825 million in 3Q24 but slightly higher than R$748 million in 4Q23. The adjusted EBITDA margin contracted 8.2 percentage points QoQ and 3.6 percentage points YoY to 25.2% in 4Q24, compared to 33.4% in 3Q24 and 28.8% in 4Q23. Higher COGS primarily drove the decline on a cash basis due to the impact of Suzano Packaging's U.S. operations, combined with increased SG&A expenses. Lower input costs, reduced wood costs, and higher sales volumes partially offset these factors. As a result, adjusted EBITDA per ton fell 23.9% QoQ and 9.8% YoY to R$1,746 per ton in 4Q24, down from R$2,294 per ton in 3Q24 and R$1,936 per ton in 4Q23.

In USD terms, paper adjusted EBITDA declined 13.5% QoQ to $129 million in 4Q24, compared to $149 million in 3Q24 and $151 million in 4Q23.

Financial Profile – 4Q24

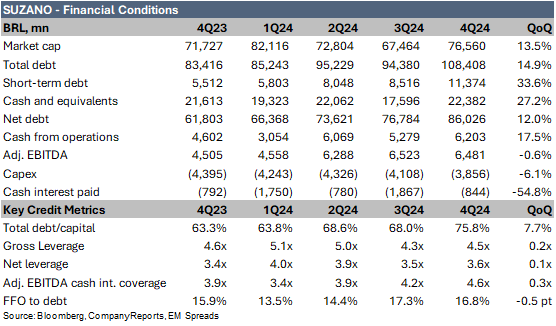

Suzano ended 4Q24 with total debt of R$108.4 billion, including R$7.0 billion in lease liabilities, representing a R$14.0 billion increase from R$94.4 billion in September 2024 (December 2023: R$83.4 billion). The sequential increase was primarily driven by an FX variation of approximately R$9.7 billion and R$3.6 billion in funding operations completed during the quarter. Cash and cash equivalents improved to R$22.4 billion as of December 2024, up from R$17.6 billion in September 2024 and R$21.6 billion in December 2023. As a result, net debt rose by R$9.2 billion sequentially to R$86.0 billion in December 2024, compared to R$76.8 billion in September 2024 and R$61.8 billion in December 2023.

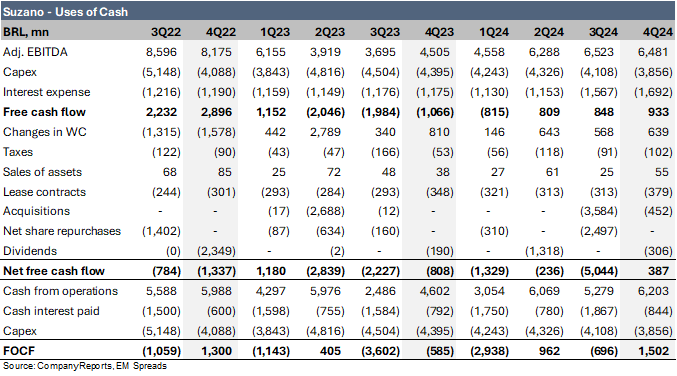

Adjusted EBITDA of R$6.5 billion in 4Q24 was sufficient to cover R$3.9 billion in capital expenditures and R$1.7 billion in interest expenses, resulting in free cash flow of R$933 million. This reflects a sequential improvement from a free cash inflow of R$848 million in 3Q24 and a significant turnaround from a free cash outflow of R$1.1 billion in 4Q23.

After accounting for a R$639 million working capital inflow, R$102 million in taxes, R$55 million in asset sales, R$452 million in acquisitions, and R$306 million in dividends, Suzano reported net free cash flow of R$387 million for the quarter. This marks a sharp improvement from net free cash outflows of R$5.0 billion in 3Q24 and R$808 million in 4Q23.

Funds from operations (FFO), calculated as adjusted EBITDA minus cash interest and cash taxes, totaled R$5.5 billion in 4Q24. Adjusted EBITDA of R$6.5 billion comfortably covered R$844 million in cash interest payments and R$102 million in cash tax payments. This represents an improvement from R$4.6 billion in 3Q24 and R$3.7 billion in 4Q23. We note that the company typically incurs higher interest payments in the first and third quarters compared to the second and fourth quarters.

Free operating cash flow (FOCF), calculated as cash from operations minus capital expenditures and interest paid, resulted in an inflow of R$1.5 billion in 4Q24. This marks a significant improvement from an outflow of R$696 million in 3Q24 and an improvement from an outflow of R$585 million in 4Q23.

Key Credit Metrics

Key credit metrics were mixed, as LTM adjusted EBITDA increased 9.0% sequentially, while the debt balance grew 14.9% QoQ. Cash generation benefited from lower capex, acquisitions, and share repurchases, though dividend payments partially offset this. As a result, the company ended the quarter with a stronger cash position.

Gross leverage increased to 4.5x as of December 2024 from 4.3x as of September 2024 (December 2023: 4.6x).

Net leverage modestly worsened to 3.6x as of December 2024, up from 3.5x as of September 2024 (December 2023: 3.4x).

Net leverage excluding lease liabilities (as calculated by the company) was 3.3x as of December 2024, up from 3.2x as of September 2024 (December 2023: 3.0x).

Cash interest coverage increased to 4.6x as of December 2024 from 4.2x as of September 2024 (December 2023: 3.9x).

FFO to total debt decreased sequentially to 16.8% as of December 2024 from 17.3% as of September 2024 (December 2023: 15.9%).

Liquidity

We assess Suzano’s liquidity as strong. As of December 2024, the company had R$10.5 billion in short-term debt, representing 46.9% of its cash position and 9.7% of total debt. With R$22.4 billion in cash and cash equivalents, along with R$7.9 billion (US$1.3 billion) in available standby facilities maturing in February 2027, total liquidity stood at R$30.3 billion. Suzano’s liquidity is sufficient to cover its debt obligations through 2026 and most of 2027. Approximately 29% of cash and equivalents is held in foreign currency, while the remaining 71% is in local currency.

The company has maintained a strong cash position in recent years, with cash and equivalents averaging over R$19.7 billion since 1Q22. During this period, short-term debt has averaged around 25.9% of its cash position. Additionally, Suzano has a US$800 million agreement with Finnvera related to the Cerrado Project, further strengthening its liquidity. The company’s credit facilities do not include maintenance covenants.

Suzano’s debt maturity profile is well-distributed, with an average debt life of 73 months compared to 77 months at the end of 3Q24. Regarding currency exposure, 90% of gross debt is denominated in USD. However, 88% of total revenues in 4Q24 generated from exports mitigates some of its exposure to the Brazilian real. The company has minimal floating-rate debt exposure, with 74% fixed in USD, 15% tied to SOFR, 9% to CDI, and 1% fixed in BRL.

Given the cyclical nature of the pulp industry and Suzano’s strategy to expand its U.S. paper market presence through targeted acquisitions rather than transformative M&A, we view its high liquidity position as prudent. Additionally, Suzano has strong access to debt and equity markets. In periods of financial stress, liquidity could be further strengthened through the potential sale of forestry and other non-strategic assets.

See Also:

Initiating Coverage on SUZANO: Headline Risk Limits Upside Potential

Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.