U.S. Tariffs and Their Potential Impact on Cemex and Pemex

Assessing the Broader Credit and Risk Implications for Cemex and Pemex

Mexico

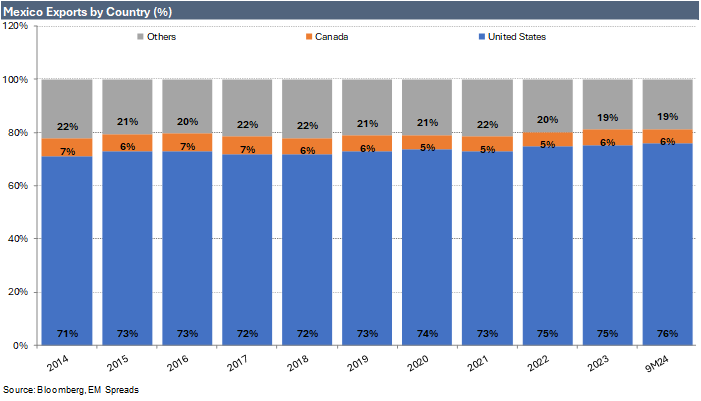

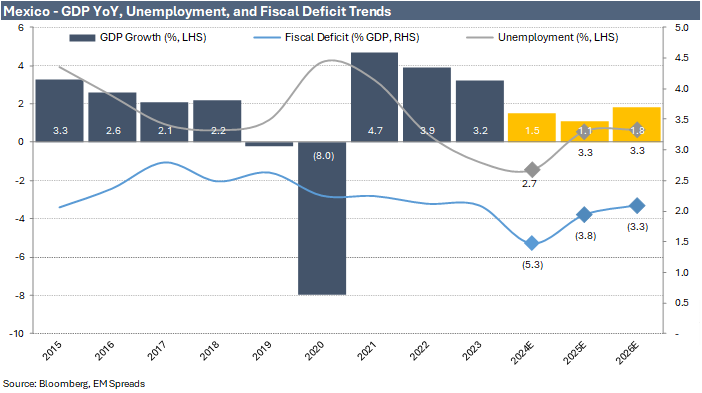

Mexico's economy is highly exposed to U.S. tariffs due to its deep trade integration with the United States, underpinned by the United States-Mexico-Canada Agreement (USMCA). In 2023, 75.3% of Mexico’s exports went to the U.S., rising to 75.8% in the first nine months of 2024. This makes it the most dependent economy in Latin America on American demand. This heavy reliance spans key industries such as automotive manufacturing, electronics, and agriculture, where supply chains are tightly linked across the border.

Moreover, Mexico serves as a key production hub for U.S. companies, benefiting from lower labor costs and geographic proximity. Many industries operate within North American supply chains, meaning that tariffs on Mexican goods can disrupt operations, increase costs, and reduce competitiveness. Given the scale of these trade flows, any imposition of tariffs by the U.S. could create significant ripple effects on Mexico’s economic growth, investment climate, and employment.

Cemex

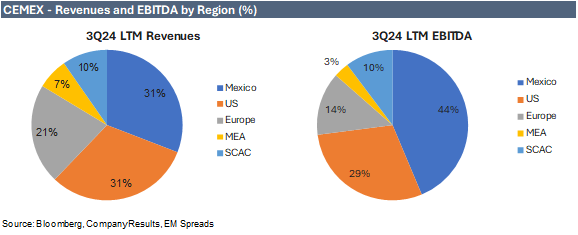

Cemex has been advancing its growth-oriented portfolio optimization by executing strategic divestments, particularly in selected Emerging Markets, to streamline its holdings and drive further investment in the U.S., Mexico, and Europe, primarily through bolt-on opportunities. Consequently, we expect Cemex’s exposure to the U.S. to continue increasing in 2025, given the company’s strategy and the divestment of its Dominican Republic operations, which represented 2.1% of 2023 revenues and 4.2% of EBITDA. In the last twelve months ending in September 2024, the company generated approximately 31% of its revenues in Mexico and 31% in the U.S., while 44% of its EBITDA came from Mexico and 29% from the U.S.

Even though U.S. tariffs would not significantly affect Cemex’s exports from Mexico to the U.S., the company has sizeable operations within the U.S. and exports only a small portion of its output. However, the broader economic impact of tariffs on Mexico, including potential currency depreciation and a recession, could weigh more heavily on Cemex’s domestic operations. This is particularly relevant given the substantial portion of EBITDA the company generates in its domestic market.

Despite these risks, Cemex’s credit-positive strategic priorities, commitment to strengthening its credit profile, end-market diversification, solid credit metrics, and ample liquidity provide some level of comfort in its ability to navigate tariff uncertainty. However, if the U.S. imposes tariffs on Mexico, we expect a meaningful negative impact on Cemex’s operational performance, particularly in its domestic market. As a result, we would anticipate credit metrics to deteriorate. This risk is further magnified by the fact that much of the positive outlook for Cemex has been based on expectations of robust infrastructure and housing spending in Mexico, supported in part by nearshoring and government-led investment. If tariffs lead to a sharp economic slowdown, many of these initiatives could be delayed or scaled back, exacerbating the negative impact on Cemex’s domestic operating performance and credit profile.

Pemex

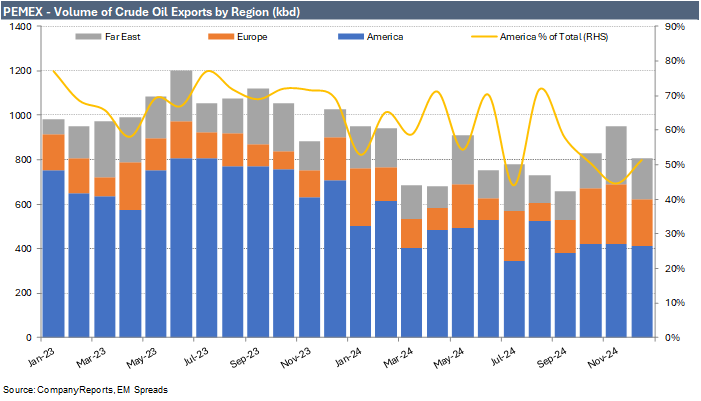

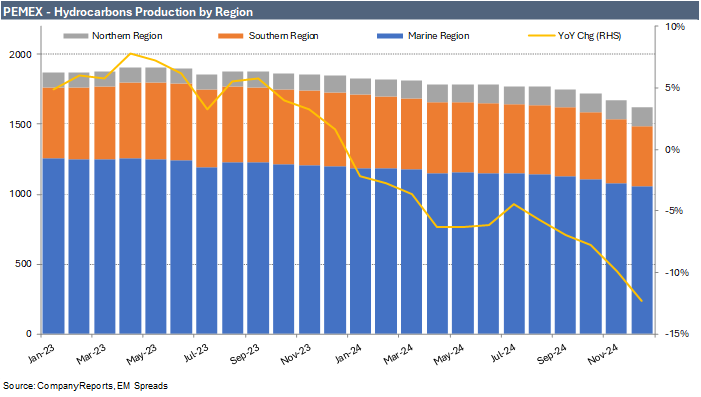

The U.S. market represents a meaningful portion of Pemex’s crude exports. In 2024, the company exported 460 kbd, accounting for 57.1% of total exports and 26.5% of total production of 1,741 kbd, which includes contributions from partners. Pemex has reduced its overall exports in recent years, primarily due to production declines. In comparison, the company exported approximately 638 kbd to the U.S. in 2022 and 720 kbd in 2023, representing 66.9% and 69.7% of total crude exports, respectively.

Consequently, potential U.S. tariffs on Mexico could significantly negatively impact Pemex. Even though the company has some capacity to redirect exports to Europe and other regions, this could lead to additional logistical costs and lower realized prices, further affecting operational performance.

Additionally, Pemex’s credit story remains highly dependent on financial support from the Mexican government, given its unsustainable standalone credit profile, which is characterized by a significant debt burden, weak liquidity, high debt service costs, and persistent negative cash flows. Potential tariffs would likely put further pressure on the overall Mexican economy, which serves as the implicit guarantee for Pemex’s debt, reducing the government’s ability to provide support. Mexico is already projected to run a 3.8% fiscal deficit in 2025 without accounting for tariffs, which would likely widen if tariffs were implemented. This could lead to significantly lower confidence in the government’s capacity to back Pemex’s debt, further weakening the company’s credit profile.

This uncertainty compounds existing challenges, including ongoing payment delays to suppliers and contractors, with outstanding debts totaling P$402.9 billion (US$19.6 billion) as of September 2024. These concerns, combined with production declines and deteriorating operational metrics, will likely increase Pemex’s reliance on government assistance.

See Also:

Pemex: Lack of Concrete Action Weights on the Outperform Thesis

Initiating Coverage on PEMEX: Set to Outperform on Reclassification Potential

Cemex: The Promising Credit Story of a Regional Leader in the Cement Industry

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.