YPF to Price USD 9NC4 Unsecured Notes (IPT: 8.75%, Guidance: 8.50%)

We recommend to “BUY” the new YPFAR 2034 at 8.5%

USD Benchmark 9NC4 Senior Unsecured Issuance

YPF is launching a USD benchmark-sized 9NC4 senior unsecured notes issuance, with expected CCC/CCC ratings from S&P and Fitch, respectively. Proceeds are expected to be used for debt repayment and/or refinancing, including a concurrent tender offer and the redemption of its 2025 notes, as well as for investment in fixed assets and business acquisitions in Argentina.

The notes will amortize in three installments: 30% in January 2032, 30% in January 2033, and the remaining 40% at final maturity in 2034. Pricing is expected today, with initial price talk around 8.75%, and now guided at 8.5%.

Trade Recommendation

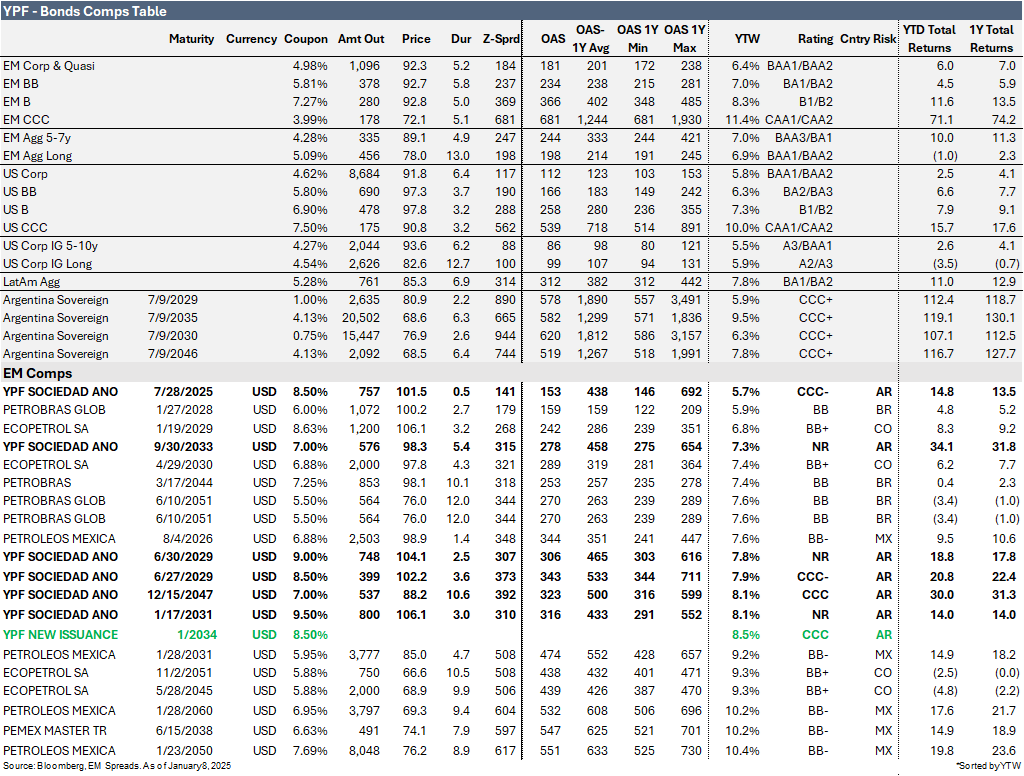

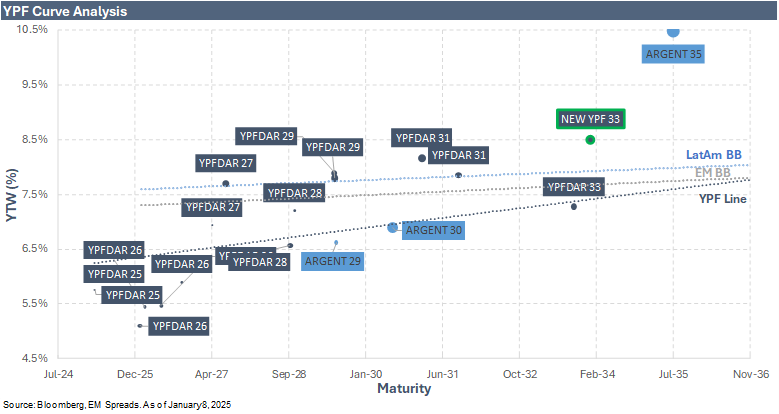

We recommend to “BUY” the new YPFAR 2034 (9NC4). At 8.500%, we find the notes attractive relative to the YPFAR 7.000% 2033s unsecured bonds, which yield 7.3% for a 5.4-year duration, and the YPFAR 8.750% 2031s unsecured bonds, yielding 7.8% for a 4.0-year duration.

We believe these bonds offer an appealing yield within YPF’s debt capital structure and are currently trading wide relative to the broader LatAm BB and EM BB curves. Meanwhile, YPF’s shorter-dated bonds are trading at or near par, limiting further upside potential.

Credit Impact - Positive

YPF’s issuance and tender offer represent a strategic move to mitigate refinancing risks ahead of the 2025 bond maturity wall. If successful, this initiative will enhance liquidity by extending USD-denominated maturities and securing longer-term funding during a period of heavy investment, which we expect to result in negative cash flow. We anticipate YPF will successfully refinance these bonds, supported by an improved operating performance in 2024 and more favorable macroeconomic conditions in Argentina.

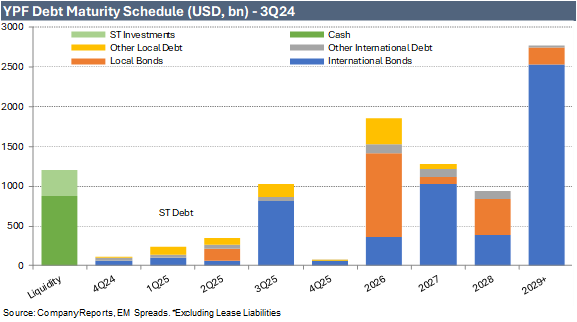

As shown in the 3Q24 debt maturity chart below, a successful transaction would significantly reduce YPF’s short-term USD-denominated debt, strengthening liquidity and lowering refinancing risk. The impact on interest expense should be minimal, as the company plans to exchange its 8.5% 2025 notes for new notes expected to carry the same coupon.

YPF Launches Tender Offer for July 2025 Bonds

On January 2, 2025, YPF S.A. (Caa3/CCC/CCC) announced a cash tender offer to repurchase all of its outstanding 8.500% Senior Notes due July 2025, with a total principal amount of $757 million. The company is offering $1,019.50 per $1,000 of principal to bondholders participating in the offer. The tender offer will expire on January 15, 2025, at 5:00 p.m. New York time, with settlement expected on January 17, 2025. A guaranteed delivery settlement for securities tendered under special conditions is scheduled for January 21, 2025.

The offer is contingent on YPF successfully raising new debt through a concurrent or prior bond issuance. Investors who tender their bonds early may receive preferential treatment in the allocation of the new issuance. This move underscores YPF’s proactive approach to managing upcoming maturities, aiming to reduce short-term refinancing risk and improve its overall debt profile.

YPF has also indicated that it may redeem any remaining bonds after the tender offer, though it is not obligated to do so. This initiative is part of a broader liability management strategy to strengthen financial stability amid Argentina’s challenging economic environment.

The premium pricing of the tender offer provides a strong incentive for bondholders to participate. The success of this transaction will depend on investor appetite for YPF’s new issuance and broader market conditions.

See Also:

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.